Shopify x ChatGPT Partnership: Timeline, Integration Mechanics, and the Future of Conversational Commerce

Shopify x ChatGPT Partnership: Timeline, Integration Mechanics, and the Future of Conversational Commerce

Shopify x ChatGPT Partnership: Timeline, Integration Mechanics, and the Future of Conversational Commerce

Shopify and OpenAI launched a new integration that lets over 1 million US Shopify merchants sell products directly inside ChatGPT using Instant Checkout. This turns ChatGPT from a search tool into a full shopping channel, merging product discovery and purchase into one conversation.

ALLMO.ai Team

ALLMO.ai Team

ALLMO.ai Team

Nov 28, 2025

Nov 28, 2025

Nov 28, 2025

Shopify - ChatGPT Partnership: Timeline, Integration Mechanics, and the Future of Conversational Commerce

TL;DR: On September 29, 2025, Shopify and OpenAI officially launched an integration that allows over 1 million U.S. Shopify merchants to sell products directly within ChatGPT conversations via Instant Checkout. This partnership transforms conversational AI from information tool to full commerce channel, compressing discovery and purchase into seamless dialogue. With the U.S. e-commerce market exceeding $1.2 trillion in 2024 and AI-in-commerce projected to grow from $8 billion to $64 billion by 2034, this integration positions Shopify at the forefront of agentic commerce while creating urgent optimization challenges for merchants adapting to AI-driven product discovery.

Timeline at a glance: from early signals to Instant Checkout

The Shopify–ChatGPT partnership evolved rapidly from backend code hints to a full-scale commerce channel in under a year.

Early 2025 brought the first concrete signals when developers discovered code references to Shopify shopping features embedded in ChatGPT's infrastructure. Around the same time, OpenAI quietly listed Shopify among verified third-party data providers alongside established partners like Bing, suggesting that commerce pilots were already underway. These technical breadcrumbs indicated that conversational shopping was moving from experimental concept to imminent product.

The phased rollout began mid-2025 with OpenAI testing commerce capabilities through Etsy sellers, validating both the conversational product discovery flow and in-chat purchase mechanics before scaling to larger merchant networks. This cautious approach allowed OpenAI to refine the user experience and work through technical integration challenges with a manageable cohort of sellers.

The official launch arrived on September 29, 2025, when Shopify and OpenAI announced that over 1 million U.S. Shopify merchants could now surface their products in ChatGPT and complete sales via Instant Checkout: a proxy commerce system powered by Stripe that eliminates the need to redirect users to external websites. Initial brand partners included premium names like Glossier, Spanx, SKIMS, Vuori, Away, Stanley 1913, and Steve Madden, signaling that established retailers saw strategic value in the channel. Merchants gained the flexibility to choose between Instant Checkout, which keeps buyers within the ChatGPT environment, or traditional link-out flows that direct traffic to their owned storefronts.

Market reaction was immediate: on announcement day, Etsy's shares surged nearly 16% and Shopify's stock rose over 6%, reflecting investor confidence that AI-driven commerce represented a meaningful new revenue stream rather than a speculative experiment.

What the integration enables today

The Shopify–ChatGPT integration introduces a fundamentally different commerce experience built around natural language rather than search keywords or browsing categories.

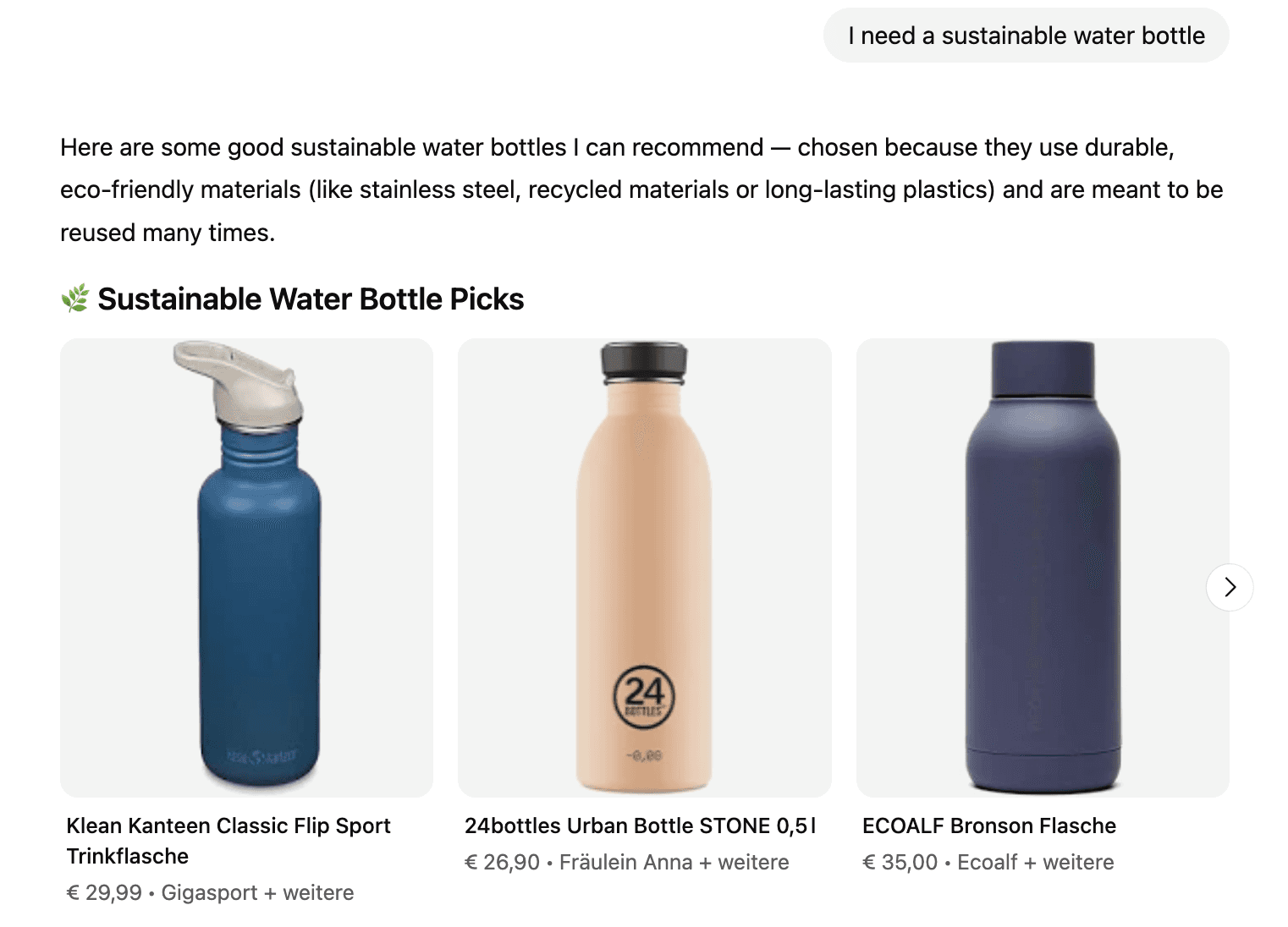

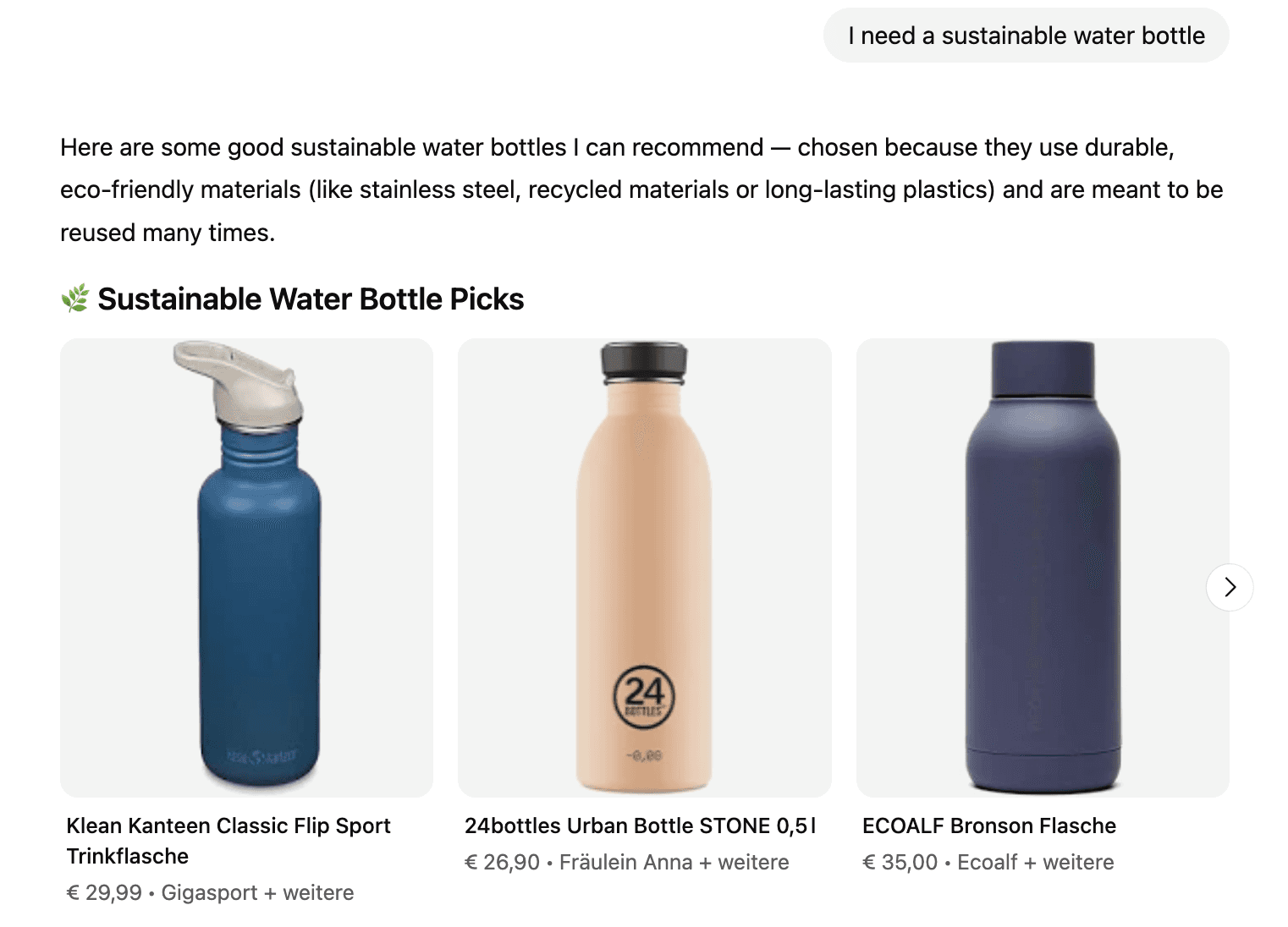

Product discovery inside ChatGPT now responds to conversational shopping requests with structured product cards that pull directly from Shopify merchant catalogs. When a user asks "I need a sustainable water bottle for hiking," ChatGPT can surface relevant Shopify products complete with merchant attribution, pricing, imagery, and key specifications—all without the user needing to open a browser tab or navigate a traditional e-commerce site. This represents a shift from pull-based shopping, where consumers hunt for products, to push-based dialogue where the AI agent curates options in context.

The integration supports two checkout modes designed to balance convenience with merchant control:

Instant Checkout enables users to complete purchases entirely within the ChatGPT interface via a Stripe-powered proxy that handles payment processing while maintaining merchant brand identity and attribution. This flow prioritizes speed and reduces friction for impulse purchases or gift-buying scenarios where the buyer wants an immediate resolution.

The alternative link-out mode routes users to the merchant's standard checkout, preserving existing site analytics, custom upsell flows, and customer data capture while still benefiting from ChatGPT's discovery layer.

Behind the scenes, operations remain firmly in merchant hands. Orders placed via Instant Checkout flow into the merchant's existing Shopify fulfillment queue exactly as they would from the merchant's website or any other sales channel. Payment settlement follows established rails through Stripe, and all return policies, customer service protocols, and inventory management stay under merchant control. This architectural choice reduces onboarding complexity and ensures that AI commerce feels like an extension of current operations rather than a separate system to maintain.

For buyers, the value proposition centers on reduced cognitive load. Instead of comparing dozens of product pages across multiple tabs, users receive conversational guidance that narrows choices based on their stated preferences, then see structured product information that supports informed decisions. The combination of dialogue flexibility with transactional clarity aims to compress the time from "I wonder if…" to "Order confirmed."

Why it matters: Shopify's position in the AI-commerce ecosystem

The Shopify–ChatGPT partnership represents a strategic bet on conversational commerce becoming a primary discovery channel alongside (or instead of) traditional search and paid advertising.

Conversational and agentic commerce fundamentally reframes the customer journey. Instead of users formulating keyword queries, clicking through search results, and bouncing between comparison sites, they articulate intent in natural language and receive curated recommendations that factor in context, constraints, and preferences expressed during the conversation. This shift moves Shopify's merchant network directly in front of high-intent queries at the exact moment purchase intent crystallizes, bypassing the upper funnel entirely for many transactions.

Shopify gains a significant distribution advantage by becoming the default supply-side backbone for ChatGPT shopping. While OpenAI piloted commerce with Etsy sellers first, the Shopify integration scales access to over 1 million merchants spanning virtually every product category and price point. This breadth accelerates category coverage for OpenAI while positioning Shopify as the infrastructure layer for AI commerce, similar to how it serves as the backend for direct-to-consumer brands, enterprise retailers, and omnichannel sellers across traditional e-commerce.

The strategic upside for merchants includes expanded organic discovery surface area without incremental ad spend, potentially higher conversion rates from in-context guidance that pre-qualifies buyers, and a foundation for future AI-native shopping features like personalized gift recommendations, voice ordering, and conversational post-purchase support. For Shopify, deeper ChatGPT integration strengthens platform lock-in and creates optionality for future monetization, whether through premium placement programs, enhanced analytics tiers, or transaction fees on AI-originated orders.

Brand visibility and attribution inside ChatGPT

Maintaining brand identity and attribution within a conversational interface presents novel challenges compared to traditional e-commerce where merchants control every pixel of the buyer experience.

Products surface in ChatGPT as product cards that display essential attributes: product title, pricing, primary imagery, and clear merchant attribution. When users select link-out options, they preserve the brand's owned destination and full site experience, including custom merchandising, loyalty program messaging, and post-purchase upsell opportunities. Instant Checkout maintains merchant brand identity throughout the transaction flow even though payment processing occurs via Stripe proxy, ensuring buyers understand which merchant fulfilled their order.

Attribution paths differ by checkout mode. For Instant Checkout transactions, the sale records within Shopify's order management system with metadata indicating ChatGPT as the originating channel, allowing merchants to track AI-driven revenue separately from web, social, or marketplace channels. Link-out flows preserve standard referral context through UTM parameters or channel tags, enabling merchants to attribute conversions to ChatGPT traffic in their existing analytics platforms.

Discovery dynamics inside ChatGPT likely depend on multiple signals, though the exact ranking algorithm remains undisclosed. Probable inputs include catalog data quality and completeness, product metadata freshness and accuracy, relevance scoring based on semantic similarity between user queries and product descriptions, inventory availability, and conversational context from earlier dialogue turns. Similar to previous discovery patterns on ChatGPT, Merchants should assume that clear, detailed product information expressed in natural language will outperform keyword-stuffed or sparse listings.

Practical control levers for improving surfacing include maintaining high-resolution product imagery that renders well in card formats, comprehensive specifications covering dimensions, materials, colors, and variants, real-time inventory synchronization to avoid surfacing out-of-stock items, and explicit policy information covering shipping, returns, and warranties. These signals not only influence whether a product appears but also affect buyer confidence and conversion once surfaced.

Optimization playbook: GEO for commerce in ChatGPT

Merchants face a new optimization discipline, Generative Engine Optimization (GEO), also known as Applied Large Language Model Optimization (ALLMO), that extends beyond traditional SEO principles to address how AI agents retrieve, rank, and present products in conversational flows.

Catalog structured data forms the foundation. Merchants should enrich product titles with natural descriptors that match how buyers actually speak, not just how they search. For example, "Women's insulated winter hiking boot with Vibram sole, waterproof, size 6-11" communicates more conversational relevance than "Style W4792 Boot." Product attributes, tags, and descriptions should emphasize natural language clarity and cover dimensions, use cases, materials, compatibility, and care instructions. Pricing and availability must stay current to maintain ranking eligibility and avoid surfacing products that can't fulfill.

Merchandising signals help products stand out in a conversational recommendation flow. Highlight specific fit guidance, real-world use cases, material benefits, sizing charts, bundle opportunities, and compatibility with related products. Conversational FAQs embedded in product descriptions can pre-answer common objections or questions that might arise during a ChatGPT dialogue. Clear, customer-friendly return and shipping policies reduce perceived risk and friction for buyers who lack the ability to touch or try products before purchase, and are aligned with ChatGPTs overall sentiments towards identifying relevant companies to buy from.

Trust and social proof become even more critical when products surface without the surrounding context of a merchant's website. Customer reviews, ratings, trust badges, warranty information, and transparent shipping timelines serve as cues that influence conversion within the compressed decision window of a chat interface. Merchants should ensure these signals are visible in structured data fields that ChatGPT can access and surface.

Experimentation requires a methodical approach. Test variations in product copy to determine which phrasing or feature emphasis improves surfacing frequency. Try promotional hooks or limited-time offers to assess impact on conversion. Compare link-out versus Instant Checkout performance to understand buyer preferences and channel economics. Monitor changes in product impressions and conversion rates after catalog updates to identify what works. Since the ranking and surfacing logic will evolve, continuous testing and refinement should become standard practice.

Measurement, analytics, and governance

Quantifying ChatGPT's contribution to revenue and optimizing for the channel require robust attribution frameworks and operational discipline.

Attribution setup should begin with channel tagging conventions. For link-out flows, append UTM parameters or Shopify channel tags to outbound links so web analytics and Shopify reporting can isolate ChatGPT-driven sessions and conversions. For Instant Checkout transactions, ensure Shopify analytics correctly maps the channel field to identify AI-originated orders. Consider creating unique promo codes for ChatGPT discovery campaigns to capture directional signal even when attribution breaks.

Core KPIs must adapt to conversational commerce mechanics. Track impression-to-click rate to measure how often product cards generate engagement, add-to-cart rate for Instant Checkout flows, conversion rate by checkout mode, average order value, return rates, and customer lifetime value by acquisition channel. Compare these metrics against other channels—social commerce, Google Shopping, affiliate—to assess ChatGPT's relative efficiency and profitability.

Operational readiness extends beyond technology. Align customer support and returns workflows to handle AI-initiated orders, which may arrive with different context or buyer expectations than traditional web purchases. Update product descriptions, policies, and FAQ content to address questions that commonly arise in conversational shopping. Train support teams to recognize and troubleshoot ChatGPT-specific issues, such as discrepancies between what was described in the chat versus what was delivered.

Risks, constraints, and unknowns

Despite the promise, merchants and the ecosystem face material constraints and open questions that will shape near-term adoption and long-term viability.

Technical and resourcing hurdles can challenge smaller merchants. Maintaining clean product feeds, ensuring real-time inventory synchronization, and implementing checkout API protocols require technical literacy and ongoing attention. Merchants without dedicated e-commerce or development resources may struggle to optimize catalogs for AI discovery or troubleshoot integration issues, creating a potential advantage gap favoring larger, better-resourced brands.

Business terms remain opaque in several critical areas. Public announcements have not disclosed whether Shopify or OpenAI will introduce fees, take rates, or paid placement programs for featured product positioning within ChatGPT. Merchants should budget conservatively and monitor for announcements of new commercial terms that could affect channel economics. The absence of disclosed financial arrangements also makes it difficult to model return on investment or compare ChatGPT commerce to paid channels with transparent cost structures.

Governance challenges center on brand safety, accuracy, and regulatory compliance. Conversational AI may inadvertently misrepresent product features, availability, or policies if catalog data is incomplete or ambiguous. Merchants must monitor how their products are described in ChatGPT dialogues and flag inaccuracies or misleading statements that could violate consumer protection regulations or harm brand reputation. Establishing feedback loops and correction mechanisms will be essential as the technology matures. Prompt monitoring and sentiment analysis can serve as early warning indicators.

Outlook: what's next for Shopify + ChatGPT

The current integration lays groundwork for a much richer set of AI-native commerce capabilities that could redefine how shopping happens online.

Personalized recommendations represent the near-term frontier. By leveraging deeper conversational context, like user preferences expressed over multiple turns, gift recipient profiles, purchase history for returning buyers, ChatGPT can tailor product suggestions to individual needs far more dynamically than traditional recommendation engines. This could reduce decision fatigue, improve match quality, and increase conversion rates for complex or high-consideration purchases.

Richer commerce flows will extend beyond single-item purchases. Future iterations may support multi-item shopping carts, cross-sell and upsell prompts delivered conversationally, subscription sign-ups, preorder campaigns, and post-purchase support tasks like tracking shipments or initiating returns. All handled by AI agents without requiring users to navigate separate interfaces. This evolution would position ChatGPT as a full lifecycle commerce assistant rather than just a discovery tool.

Merchant analytics powered by conversational data could unlock entirely new optimization insights. Imagine dashboards that surface the most common query themes driving product views, frequent objections or questions that prevent conversion, and drop-off points in the conversational funnel. This intelligence would inform catalog improvements, pricing strategy, and customer experience design in ways that traditional web analytics cannot capture.

The ecosystem will likely expand along multiple dimensions. Geographic expansion beyond the U.S., voice and multimodal shopping experiences that blend text with image or video, integration with wearable devices and smart home assistants, and the emergence of native AI-commerce networks where discovery, negotiation, and fulfillment all occur within conversational agents. OpenAI and Shopify may also introduce sponsored placement programs or premium merchant tiers that offer enhanced visibility, advanced analytics, or priority support.

The brands that will thrive in this emerging landscape are those that treat ChatGPT commerce as a performance channel deserving dedicated resources, rigorous measurement, and continuous experimentation—not as a novelty or afterthought.

FAQ: Shopify–ChatGPT commerce, answered

Who is eligible and how do merchants enable the integration?

Initially, over 1 million Shopify merchants in the United States are eligible to participate. Merchants must have an active Shopify store with up-to-date product catalogs, including accurate pricing, inventory, and product metadata. Onboarding typically involves opting into the ChatGPT sales channel within Shopify's admin interface and configuring checkout preferences (Instant Checkout vs. link-out). Prerequisites include ensuring catalog data quality, maintaining real-time inventory sync, and agreeing to OpenAI's and Shopify's commercial terms.

How does Instant Checkout differ from link-out?

Instant Checkout completes the entire purchase flow within the ChatGPT interface, using Stripe as a payment proxy to process transactions while preserving merchant brand attribution. Buyers never leave ChatGPT, which reduces friction and accelerates conversion. Link-out, by contrast, directs users to the merchant's website for standard checkout, preserving full control over the buyer experience, upsell opportunities, and customer data capture. Fulfillment and order management remain identical for both paths, flowing through the merchant's existing Shopify systems.

How are products ranked or surfaced?

While OpenAI has not disclosed the exact algorithm, ranking likely depends on catalog completeness, metadata quality, semantic relevance to the user's query, product availability, and conversational context. Merchants should prioritize natural-language product titles and descriptions, comprehensive attributes (size, material, use case), high-resolution images, accurate pricing and inventory, and clear policies. Keeping data fresh and structured improves the likelihood of surfacing in relevant conversations.

What does attribution look like for reporting?

For Instant Checkout, orders are tagged with ChatGPT as the originating channel within Shopify analytics, enabling merchants to track AI-driven revenue separately. Link-out flows use UTM parameters or channel tags appended to outbound URLs, allowing standard web analytics to attribute conversions to ChatGPT referrals. Merchants can also create unique promo codes for ChatGPT campaigns to capture directional performance data even when technical attribution breaks.

What merchant data is shared with ChatGPT?

Product catalog data (titles, descriptions, pricing, images, availability) is shared to enable discovery and display. For Instant Checkout, transaction data flows through Stripe's proxy, with order details recorded in Shopify. Personal buyer information is governed by Stripe's and OpenAI's privacy policies; merchants should review data sharing agreements to understand what usage, order, and buyer data may be accessed or aggregated. Link-out flows minimize data sharing, as most buyer interaction occurs on the merchant's owned site.

Can brands opt out or limit assortment?

Yes. Merchants can choose not to enable the ChatGPT channel, effectively opting out entirely. For those who participate, Shopify's catalog management tools allow exclusion of specific products or collections from ChatGPT surfacing, enabling brands to control which assortment appears in conversational shopping while maintaining full catalogs for other channels.

When will it expand internationally and to more features (e.g., multi-item carts)?

The September 2025 launch focused on U.S. merchants; OpenAI and Shopify have not announced firm timelines for international expansion or advanced features like multi-item carts, subscriptions, or conversational post-purchase support. Merchants should monitor OpenAI's and Shopify's official blogs and partner communications for updates on geographic rollout, new capabilities, and pilot programs that may precede broader releases.

Key Takeaways

The Shopify–ChatGPT integration, launched September 29, 2025, enables over 1 million U.S. merchants to sell directly within conversational AI, marking a shift from search-based discovery to dialogue-driven commerce.

Instant Checkout powered by Stripe allows purchases to complete in-chat, while link-out options preserve merchant-owned checkout flows; both paths maintain merchant control over fulfillment, policies, and customer relationships.

Market signals are strong: the U.S. e-commerce market exceeded $1.2 trillion in 2024, and AI-in-commerce is projected to grow from $8 billion to $64 billion by 2034, positioning early adopters to capture meaningful new revenue streams.

GEO / ALLMO for commerce requires natural-language catalog enrichment, real-time inventory accuracy, trust signals, and continuous experimentation to improve surfacing and conversion in ChatGPT.

Attribution and measurement depend on robust channel tagging (UTMs for link-outs, Shopify analytics mapping for Instant Checkout) and tracking KPIs like impression-to-click, add-to-cart, and conversion rates by checkout mode.

Merchants face risks including geographic and category coverage limits, technical integration challenges, undisclosed fee structures, and governance demands for brand safety and regulatory compliance.

The outlook points to personalized recommendations, multi-item carts, conversational post-purchase support, and merchant analytics that surface query themes and conversion barriers, transforming ChatGPT into a full lifecycle commerce assistant.

Brands that treat ChatGPT as a performance channel with dedicated optimization resources, disciplined measurement, and operational readiness will be best positioned as AI commerce scales globally and across modalities.

Shopify - ChatGPT Partnership: Timeline, Integration Mechanics, and the Future of Conversational Commerce

TL;DR: On September 29, 2025, Shopify and OpenAI officially launched an integration that allows over 1 million U.S. Shopify merchants to sell products directly within ChatGPT conversations via Instant Checkout. This partnership transforms conversational AI from information tool to full commerce channel, compressing discovery and purchase into seamless dialogue. With the U.S. e-commerce market exceeding $1.2 trillion in 2024 and AI-in-commerce projected to grow from $8 billion to $64 billion by 2034, this integration positions Shopify at the forefront of agentic commerce while creating urgent optimization challenges for merchants adapting to AI-driven product discovery.

Timeline at a glance: from early signals to Instant Checkout

The Shopify–ChatGPT partnership evolved rapidly from backend code hints to a full-scale commerce channel in under a year.

Early 2025 brought the first concrete signals when developers discovered code references to Shopify shopping features embedded in ChatGPT's infrastructure. Around the same time, OpenAI quietly listed Shopify among verified third-party data providers alongside established partners like Bing, suggesting that commerce pilots were already underway. These technical breadcrumbs indicated that conversational shopping was moving from experimental concept to imminent product.

The phased rollout began mid-2025 with OpenAI testing commerce capabilities through Etsy sellers, validating both the conversational product discovery flow and in-chat purchase mechanics before scaling to larger merchant networks. This cautious approach allowed OpenAI to refine the user experience and work through technical integration challenges with a manageable cohort of sellers.

The official launch arrived on September 29, 2025, when Shopify and OpenAI announced that over 1 million U.S. Shopify merchants could now surface their products in ChatGPT and complete sales via Instant Checkout: a proxy commerce system powered by Stripe that eliminates the need to redirect users to external websites. Initial brand partners included premium names like Glossier, Spanx, SKIMS, Vuori, Away, Stanley 1913, and Steve Madden, signaling that established retailers saw strategic value in the channel. Merchants gained the flexibility to choose between Instant Checkout, which keeps buyers within the ChatGPT environment, or traditional link-out flows that direct traffic to their owned storefronts.

Market reaction was immediate: on announcement day, Etsy's shares surged nearly 16% and Shopify's stock rose over 6%, reflecting investor confidence that AI-driven commerce represented a meaningful new revenue stream rather than a speculative experiment.

What the integration enables today

The Shopify–ChatGPT integration introduces a fundamentally different commerce experience built around natural language rather than search keywords or browsing categories.

Product discovery inside ChatGPT now responds to conversational shopping requests with structured product cards that pull directly from Shopify merchant catalogs. When a user asks "I need a sustainable water bottle for hiking," ChatGPT can surface relevant Shopify products complete with merchant attribution, pricing, imagery, and key specifications—all without the user needing to open a browser tab or navigate a traditional e-commerce site. This represents a shift from pull-based shopping, where consumers hunt for products, to push-based dialogue where the AI agent curates options in context.

The integration supports two checkout modes designed to balance convenience with merchant control:

Instant Checkout enables users to complete purchases entirely within the ChatGPT interface via a Stripe-powered proxy that handles payment processing while maintaining merchant brand identity and attribution. This flow prioritizes speed and reduces friction for impulse purchases or gift-buying scenarios where the buyer wants an immediate resolution.

The alternative link-out mode routes users to the merchant's standard checkout, preserving existing site analytics, custom upsell flows, and customer data capture while still benefiting from ChatGPT's discovery layer.

Behind the scenes, operations remain firmly in merchant hands. Orders placed via Instant Checkout flow into the merchant's existing Shopify fulfillment queue exactly as they would from the merchant's website or any other sales channel. Payment settlement follows established rails through Stripe, and all return policies, customer service protocols, and inventory management stay under merchant control. This architectural choice reduces onboarding complexity and ensures that AI commerce feels like an extension of current operations rather than a separate system to maintain.

For buyers, the value proposition centers on reduced cognitive load. Instead of comparing dozens of product pages across multiple tabs, users receive conversational guidance that narrows choices based on their stated preferences, then see structured product information that supports informed decisions. The combination of dialogue flexibility with transactional clarity aims to compress the time from "I wonder if…" to "Order confirmed."

Why it matters: Shopify's position in the AI-commerce ecosystem

The Shopify–ChatGPT partnership represents a strategic bet on conversational commerce becoming a primary discovery channel alongside (or instead of) traditional search and paid advertising.

Conversational and agentic commerce fundamentally reframes the customer journey. Instead of users formulating keyword queries, clicking through search results, and bouncing between comparison sites, they articulate intent in natural language and receive curated recommendations that factor in context, constraints, and preferences expressed during the conversation. This shift moves Shopify's merchant network directly in front of high-intent queries at the exact moment purchase intent crystallizes, bypassing the upper funnel entirely for many transactions.

Shopify gains a significant distribution advantage by becoming the default supply-side backbone for ChatGPT shopping. While OpenAI piloted commerce with Etsy sellers first, the Shopify integration scales access to over 1 million merchants spanning virtually every product category and price point. This breadth accelerates category coverage for OpenAI while positioning Shopify as the infrastructure layer for AI commerce, similar to how it serves as the backend for direct-to-consumer brands, enterprise retailers, and omnichannel sellers across traditional e-commerce.

The strategic upside for merchants includes expanded organic discovery surface area without incremental ad spend, potentially higher conversion rates from in-context guidance that pre-qualifies buyers, and a foundation for future AI-native shopping features like personalized gift recommendations, voice ordering, and conversational post-purchase support. For Shopify, deeper ChatGPT integration strengthens platform lock-in and creates optionality for future monetization, whether through premium placement programs, enhanced analytics tiers, or transaction fees on AI-originated orders.

Brand visibility and attribution inside ChatGPT

Maintaining brand identity and attribution within a conversational interface presents novel challenges compared to traditional e-commerce where merchants control every pixel of the buyer experience.

Products surface in ChatGPT as product cards that display essential attributes: product title, pricing, primary imagery, and clear merchant attribution. When users select link-out options, they preserve the brand's owned destination and full site experience, including custom merchandising, loyalty program messaging, and post-purchase upsell opportunities. Instant Checkout maintains merchant brand identity throughout the transaction flow even though payment processing occurs via Stripe proxy, ensuring buyers understand which merchant fulfilled their order.

Attribution paths differ by checkout mode. For Instant Checkout transactions, the sale records within Shopify's order management system with metadata indicating ChatGPT as the originating channel, allowing merchants to track AI-driven revenue separately from web, social, or marketplace channels. Link-out flows preserve standard referral context through UTM parameters or channel tags, enabling merchants to attribute conversions to ChatGPT traffic in their existing analytics platforms.

Discovery dynamics inside ChatGPT likely depend on multiple signals, though the exact ranking algorithm remains undisclosed. Probable inputs include catalog data quality and completeness, product metadata freshness and accuracy, relevance scoring based on semantic similarity between user queries and product descriptions, inventory availability, and conversational context from earlier dialogue turns. Similar to previous discovery patterns on ChatGPT, Merchants should assume that clear, detailed product information expressed in natural language will outperform keyword-stuffed or sparse listings.

Practical control levers for improving surfacing include maintaining high-resolution product imagery that renders well in card formats, comprehensive specifications covering dimensions, materials, colors, and variants, real-time inventory synchronization to avoid surfacing out-of-stock items, and explicit policy information covering shipping, returns, and warranties. These signals not only influence whether a product appears but also affect buyer confidence and conversion once surfaced.

Optimization playbook: GEO for commerce in ChatGPT

Merchants face a new optimization discipline, Generative Engine Optimization (GEO), also known as Applied Large Language Model Optimization (ALLMO), that extends beyond traditional SEO principles to address how AI agents retrieve, rank, and present products in conversational flows.

Catalog structured data forms the foundation. Merchants should enrich product titles with natural descriptors that match how buyers actually speak, not just how they search. For example, "Women's insulated winter hiking boot with Vibram sole, waterproof, size 6-11" communicates more conversational relevance than "Style W4792 Boot." Product attributes, tags, and descriptions should emphasize natural language clarity and cover dimensions, use cases, materials, compatibility, and care instructions. Pricing and availability must stay current to maintain ranking eligibility and avoid surfacing products that can't fulfill.

Merchandising signals help products stand out in a conversational recommendation flow. Highlight specific fit guidance, real-world use cases, material benefits, sizing charts, bundle opportunities, and compatibility with related products. Conversational FAQs embedded in product descriptions can pre-answer common objections or questions that might arise during a ChatGPT dialogue. Clear, customer-friendly return and shipping policies reduce perceived risk and friction for buyers who lack the ability to touch or try products before purchase, and are aligned with ChatGPTs overall sentiments towards identifying relevant companies to buy from.

Trust and social proof become even more critical when products surface without the surrounding context of a merchant's website. Customer reviews, ratings, trust badges, warranty information, and transparent shipping timelines serve as cues that influence conversion within the compressed decision window of a chat interface. Merchants should ensure these signals are visible in structured data fields that ChatGPT can access and surface.

Experimentation requires a methodical approach. Test variations in product copy to determine which phrasing or feature emphasis improves surfacing frequency. Try promotional hooks or limited-time offers to assess impact on conversion. Compare link-out versus Instant Checkout performance to understand buyer preferences and channel economics. Monitor changes in product impressions and conversion rates after catalog updates to identify what works. Since the ranking and surfacing logic will evolve, continuous testing and refinement should become standard practice.

Measurement, analytics, and governance

Quantifying ChatGPT's contribution to revenue and optimizing for the channel require robust attribution frameworks and operational discipline.

Attribution setup should begin with channel tagging conventions. For link-out flows, append UTM parameters or Shopify channel tags to outbound links so web analytics and Shopify reporting can isolate ChatGPT-driven sessions and conversions. For Instant Checkout transactions, ensure Shopify analytics correctly maps the channel field to identify AI-originated orders. Consider creating unique promo codes for ChatGPT discovery campaigns to capture directional signal even when attribution breaks.

Core KPIs must adapt to conversational commerce mechanics. Track impression-to-click rate to measure how often product cards generate engagement, add-to-cart rate for Instant Checkout flows, conversion rate by checkout mode, average order value, return rates, and customer lifetime value by acquisition channel. Compare these metrics against other channels—social commerce, Google Shopping, affiliate—to assess ChatGPT's relative efficiency and profitability.

Operational readiness extends beyond technology. Align customer support and returns workflows to handle AI-initiated orders, which may arrive with different context or buyer expectations than traditional web purchases. Update product descriptions, policies, and FAQ content to address questions that commonly arise in conversational shopping. Train support teams to recognize and troubleshoot ChatGPT-specific issues, such as discrepancies between what was described in the chat versus what was delivered.

Risks, constraints, and unknowns

Despite the promise, merchants and the ecosystem face material constraints and open questions that will shape near-term adoption and long-term viability.

Technical and resourcing hurdles can challenge smaller merchants. Maintaining clean product feeds, ensuring real-time inventory synchronization, and implementing checkout API protocols require technical literacy and ongoing attention. Merchants without dedicated e-commerce or development resources may struggle to optimize catalogs for AI discovery or troubleshoot integration issues, creating a potential advantage gap favoring larger, better-resourced brands.

Business terms remain opaque in several critical areas. Public announcements have not disclosed whether Shopify or OpenAI will introduce fees, take rates, or paid placement programs for featured product positioning within ChatGPT. Merchants should budget conservatively and monitor for announcements of new commercial terms that could affect channel economics. The absence of disclosed financial arrangements also makes it difficult to model return on investment or compare ChatGPT commerce to paid channels with transparent cost structures.

Governance challenges center on brand safety, accuracy, and regulatory compliance. Conversational AI may inadvertently misrepresent product features, availability, or policies if catalog data is incomplete or ambiguous. Merchants must monitor how their products are described in ChatGPT dialogues and flag inaccuracies or misleading statements that could violate consumer protection regulations or harm brand reputation. Establishing feedback loops and correction mechanisms will be essential as the technology matures. Prompt monitoring and sentiment analysis can serve as early warning indicators.

Outlook: what's next for Shopify + ChatGPT

The current integration lays groundwork for a much richer set of AI-native commerce capabilities that could redefine how shopping happens online.

Personalized recommendations represent the near-term frontier. By leveraging deeper conversational context, like user preferences expressed over multiple turns, gift recipient profiles, purchase history for returning buyers, ChatGPT can tailor product suggestions to individual needs far more dynamically than traditional recommendation engines. This could reduce decision fatigue, improve match quality, and increase conversion rates for complex or high-consideration purchases.

Richer commerce flows will extend beyond single-item purchases. Future iterations may support multi-item shopping carts, cross-sell and upsell prompts delivered conversationally, subscription sign-ups, preorder campaigns, and post-purchase support tasks like tracking shipments or initiating returns. All handled by AI agents without requiring users to navigate separate interfaces. This evolution would position ChatGPT as a full lifecycle commerce assistant rather than just a discovery tool.

Merchant analytics powered by conversational data could unlock entirely new optimization insights. Imagine dashboards that surface the most common query themes driving product views, frequent objections or questions that prevent conversion, and drop-off points in the conversational funnel. This intelligence would inform catalog improvements, pricing strategy, and customer experience design in ways that traditional web analytics cannot capture.

The ecosystem will likely expand along multiple dimensions. Geographic expansion beyond the U.S., voice and multimodal shopping experiences that blend text with image or video, integration with wearable devices and smart home assistants, and the emergence of native AI-commerce networks where discovery, negotiation, and fulfillment all occur within conversational agents. OpenAI and Shopify may also introduce sponsored placement programs or premium merchant tiers that offer enhanced visibility, advanced analytics, or priority support.

The brands that will thrive in this emerging landscape are those that treat ChatGPT commerce as a performance channel deserving dedicated resources, rigorous measurement, and continuous experimentation—not as a novelty or afterthought.

FAQ: Shopify–ChatGPT commerce, answered

Who is eligible and how do merchants enable the integration?

Initially, over 1 million Shopify merchants in the United States are eligible to participate. Merchants must have an active Shopify store with up-to-date product catalogs, including accurate pricing, inventory, and product metadata. Onboarding typically involves opting into the ChatGPT sales channel within Shopify's admin interface and configuring checkout preferences (Instant Checkout vs. link-out). Prerequisites include ensuring catalog data quality, maintaining real-time inventory sync, and agreeing to OpenAI's and Shopify's commercial terms.

How does Instant Checkout differ from link-out?

Instant Checkout completes the entire purchase flow within the ChatGPT interface, using Stripe as a payment proxy to process transactions while preserving merchant brand attribution. Buyers never leave ChatGPT, which reduces friction and accelerates conversion. Link-out, by contrast, directs users to the merchant's website for standard checkout, preserving full control over the buyer experience, upsell opportunities, and customer data capture. Fulfillment and order management remain identical for both paths, flowing through the merchant's existing Shopify systems.

How are products ranked or surfaced?

While OpenAI has not disclosed the exact algorithm, ranking likely depends on catalog completeness, metadata quality, semantic relevance to the user's query, product availability, and conversational context. Merchants should prioritize natural-language product titles and descriptions, comprehensive attributes (size, material, use case), high-resolution images, accurate pricing and inventory, and clear policies. Keeping data fresh and structured improves the likelihood of surfacing in relevant conversations.

What does attribution look like for reporting?

For Instant Checkout, orders are tagged with ChatGPT as the originating channel within Shopify analytics, enabling merchants to track AI-driven revenue separately. Link-out flows use UTM parameters or channel tags appended to outbound URLs, allowing standard web analytics to attribute conversions to ChatGPT referrals. Merchants can also create unique promo codes for ChatGPT campaigns to capture directional performance data even when technical attribution breaks.

What merchant data is shared with ChatGPT?

Product catalog data (titles, descriptions, pricing, images, availability) is shared to enable discovery and display. For Instant Checkout, transaction data flows through Stripe's proxy, with order details recorded in Shopify. Personal buyer information is governed by Stripe's and OpenAI's privacy policies; merchants should review data sharing agreements to understand what usage, order, and buyer data may be accessed or aggregated. Link-out flows minimize data sharing, as most buyer interaction occurs on the merchant's owned site.

Can brands opt out or limit assortment?

Yes. Merchants can choose not to enable the ChatGPT channel, effectively opting out entirely. For those who participate, Shopify's catalog management tools allow exclusion of specific products or collections from ChatGPT surfacing, enabling brands to control which assortment appears in conversational shopping while maintaining full catalogs for other channels.

When will it expand internationally and to more features (e.g., multi-item carts)?

The September 2025 launch focused on U.S. merchants; OpenAI and Shopify have not announced firm timelines for international expansion or advanced features like multi-item carts, subscriptions, or conversational post-purchase support. Merchants should monitor OpenAI's and Shopify's official blogs and partner communications for updates on geographic rollout, new capabilities, and pilot programs that may precede broader releases.

Key Takeaways

The Shopify–ChatGPT integration, launched September 29, 2025, enables over 1 million U.S. merchants to sell directly within conversational AI, marking a shift from search-based discovery to dialogue-driven commerce.

Instant Checkout powered by Stripe allows purchases to complete in-chat, while link-out options preserve merchant-owned checkout flows; both paths maintain merchant control over fulfillment, policies, and customer relationships.

Market signals are strong: the U.S. e-commerce market exceeded $1.2 trillion in 2024, and AI-in-commerce is projected to grow from $8 billion to $64 billion by 2034, positioning early adopters to capture meaningful new revenue streams.

GEO / ALLMO for commerce requires natural-language catalog enrichment, real-time inventory accuracy, trust signals, and continuous experimentation to improve surfacing and conversion in ChatGPT.

Attribution and measurement depend on robust channel tagging (UTMs for link-outs, Shopify analytics mapping for Instant Checkout) and tracking KPIs like impression-to-click, add-to-cart, and conversion rates by checkout mode.

Merchants face risks including geographic and category coverage limits, technical integration challenges, undisclosed fee structures, and governance demands for brand safety and regulatory compliance.

The outlook points to personalized recommendations, multi-item carts, conversational post-purchase support, and merchant analytics that surface query themes and conversion barriers, transforming ChatGPT into a full lifecycle commerce assistant.

Brands that treat ChatGPT as a performance channel with dedicated optimization resources, disciplined measurement, and operational readiness will be best positioned as AI commerce scales globally and across modalities.

About the author

ALLMO.ai Team

ALLMO.ai helps brands measure and improve their visibility in AI-generated search results like ChatGPT and Perplexity. It provides optimization insights, recommendations to increase your brands visibility, and URL warm-up to get new content crawled and discovered faster.

Check out more articles

Start your AI Search Optimization journey today!

Applied Large Language Model Optimization (ALLMO), also known as GEO/AEO is gaining strong momentum.