AI Search Trends Report - Week 52 of 2025

AI Search Trends Report - Week 52 of 2025

AI Search Trends Report - Week 52 of 2025

The AI Search Weekly Media & Publisher Report analyzes how ChatGPT and Perplexity cite sources to inform about recent developments, offering insights into citation patterns, platform behavior, and evolving publisher visibility across categories.

ALLMO.ai Team

ALLMO.ai Team

ALLMO.ai Team

Dec 22, 2025

Dec 22, 2025

Dec 22, 2025

AI Search Weekly: Publisher Visibility Report

As AI-powered search platforms continue to reshape how users discover information, understanding citation patterns across different models has become essential for publishers. This week's analysis from ALLMO.ai reveals notable shifts in source selection across ChatGPT-4, ChatGPT-5, and Perplexity, with particular patterns emerging across different content categories and geographic markets.

Read more about the methodology and see the full data at allmo.ai/trends

Top 3 Highlights towards the end of the year

1. Reuters Maintains Strong Position Despite Notable Decline

Reuters captures 35.5% of citations in Economics & Finance this week, down from the previous week, a substantial decrease that repositions it closer to other leading sources. While Reuters remains the category leader, this 29.5 percentage point reduction indicates increased citation diversity, with institutional sources like ECB (12.9%) and Financial Times (16.1%) gaining more balanced representation in financial topic responses.

2. Wikipedia Shows Consistent Cross-Platform Presence with Modest Decline

Wikipedia maintains 38.1% citation rate in General News & Politics (down from 44.0%), demonstrating its continued role as a reference source across AI platforms. The source achieves relatively balanced performance across all categories—ranging from 12.9% in Economics to 25.6% in Sports—reflecting its utility for background information and statistical data, though the slight decline suggests platforms may be diversifying their reference material citations.

3. TechCrunch Increases Visibility in Technology Coverage

TechCrunch reaches 25.5% citation rate in Start-ups & Technology topics, equal to Reuters in this category and demonstrating the value of category specialization. This maintains TechCrunch's position as a leading technology publisher alongside emerging sources like techstartups.com (17.6%) and Axios (17.6%), indicating that specialized publishers can achieve visibility comparable to general news wire services within their domains.

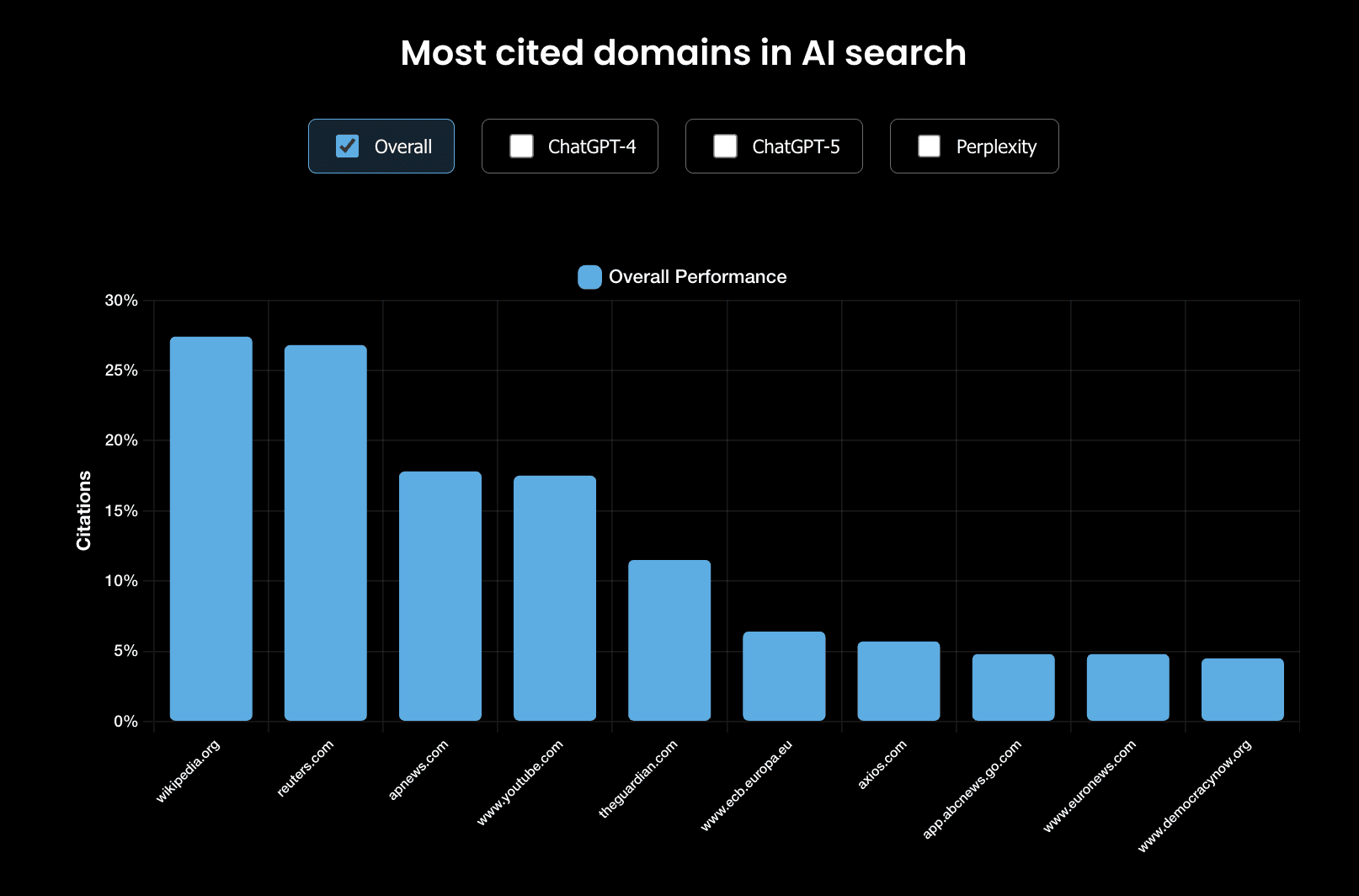

Overall Platform Performance

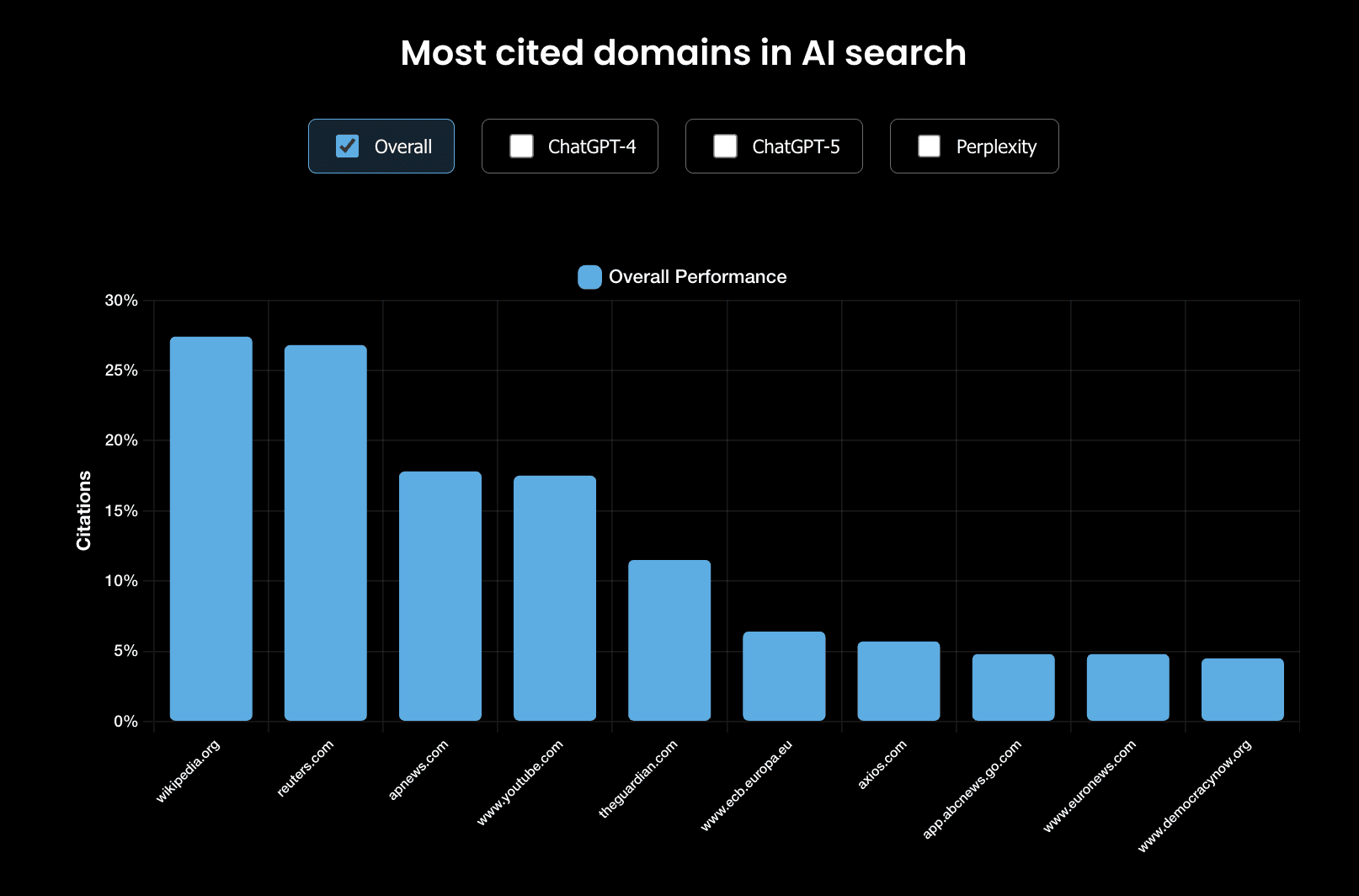

This week's data reveals distinct citation patterns across the three major AI search platforms, with each showing different preferences for source types and formats. Reuters and Wikipedia emerge as the most consistently cited sources, though their performance varies significantly by platform.

Top Sources Across All Platforms

Reuters leads overall with 35.5% in Economics & Finance and 34.5% in General News & Politics (down from 65.0% and 46.7% respectively), indicating reduced but still substantial presence across major news categories.

Wikipedia shows strong cross-category performance at 38.1% in General News & Politics (down from 44.0%), 25.6% in Sports, and 23.5% in Technology, demonstrating consistent utility across topic areas.

AP News maintains 27.4% citation rate in General News & Politics (down from 29.3%) and 19.4% in Economics & Finance (up from 15.0%), showing relative stability as a wire service source.

YouTube demonstrates significant presence at 32.1% in General News & Politics (up from 29.3%) and 15.4% in Sports (up from 11.4%), reflecting growing acceptance of video content in AI citations.

The Guardian appears across multiple categories with 23.1% in Sports (up from 8.6%) and 11.9% in General News & Politics (down from 14.7%), indicating category-specific strength variations.

Key Takeaway: The overall citation landscape shows reduced concentration compared to the previous week, with Reuters declining from its previously dominant position while other sources gain more balanced representation. This pattern suggests either a shift in platform algorithms toward citation diversity or reflects the influence of different news cycles, though the changes are substantial enough to merit publisher attention. Sources maintaining consistent presence across multiple categories indicate broader editorial relevance to AI platforms.

Category-Specific Patterns

Different content categories show markedly different citation patterns, with specialized publishers performing particularly well in their domains while wire services maintain cross-category strength.

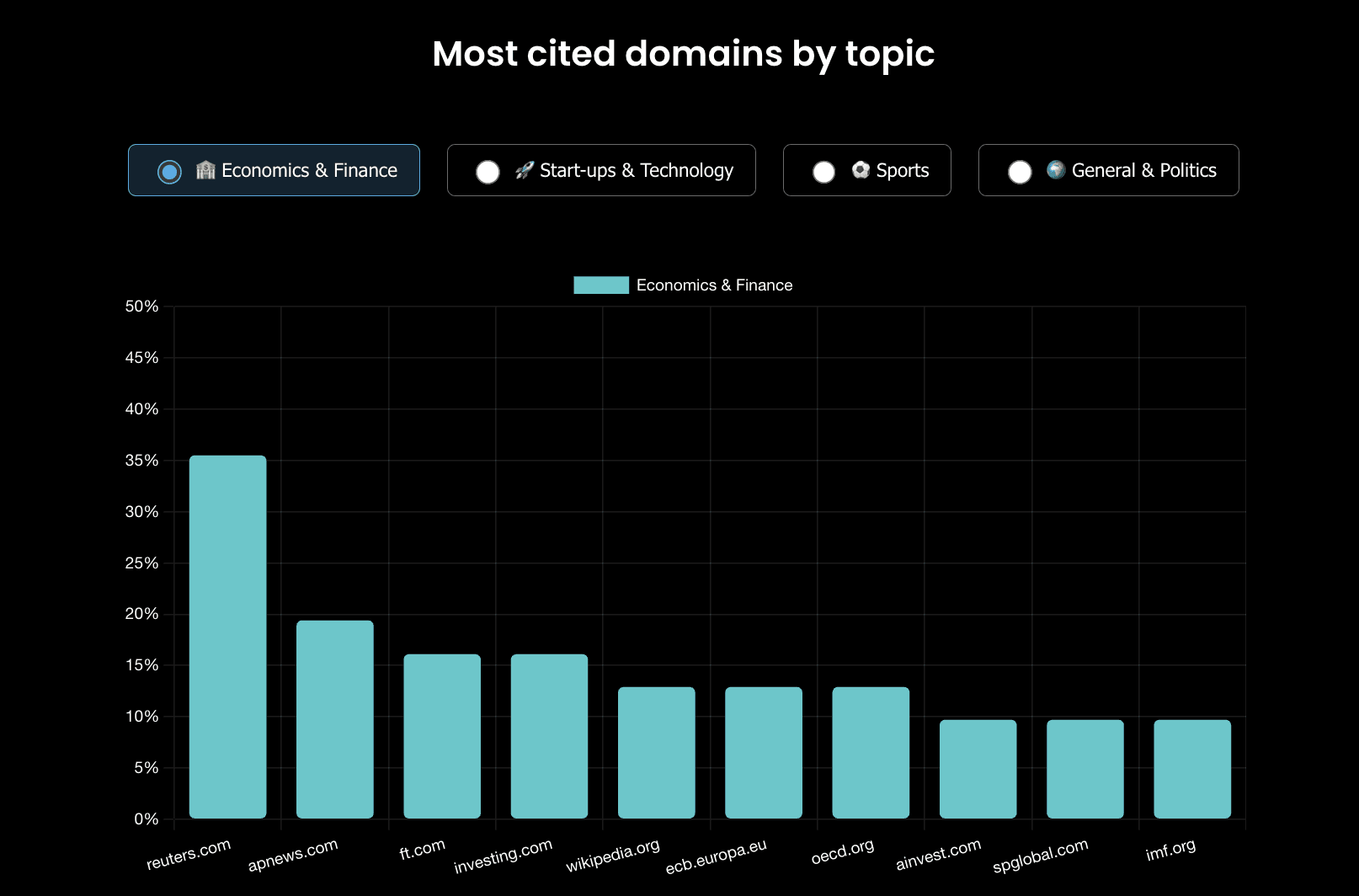

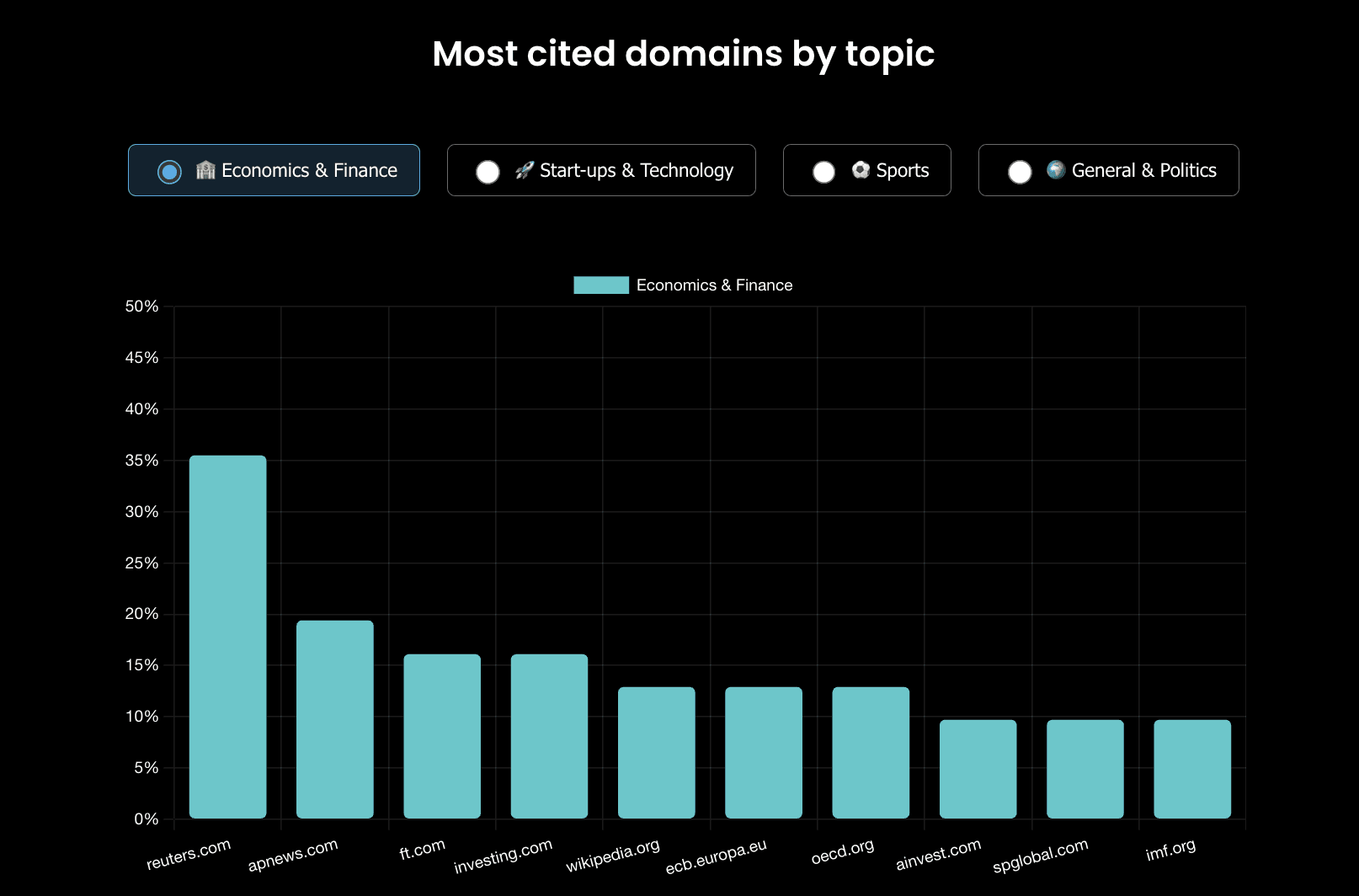

Economics & Finance

Reuters leads with 35.5% (down substantially from 65.0%), indicating reduced concentration in financial topic citations while maintaining category leadership.

AP News shows 19.4% citation rate (up from 15.0%), suggesting increased reliance on this wire service for economic news coverage.

Financial Times reaches 16.1% through its cryptoreset subdomain (up from 3.5%), demonstrating strength in specialized financial coverage with notable growth.

Investing.com maintains 16.1% (down from 20.0%), showing relatively stable presence as a financial information specialist.

European Central Bank appears at 12.9% (down from 25.0%), reflecting reduced but continued citation of institutional economic sources.

OECD (12.9%), IMF (9.7%), and S&P Global (9.7%) demonstrate that institutional and analytical sources maintain significant presence alongside news publishers.

Key Takeaway: Economics & Finance shows the most dramatic shift from last week, with Reuters declining from nearly two-thirds of citations to roughly one-third. This redistribution benefits both other wire services and institutional sources, creating a more balanced citation environment. The pattern may reflect the week's economic news mix favoring diverse source types, or could indicate platform adjustments toward representing multiple perspectives on financial topics.

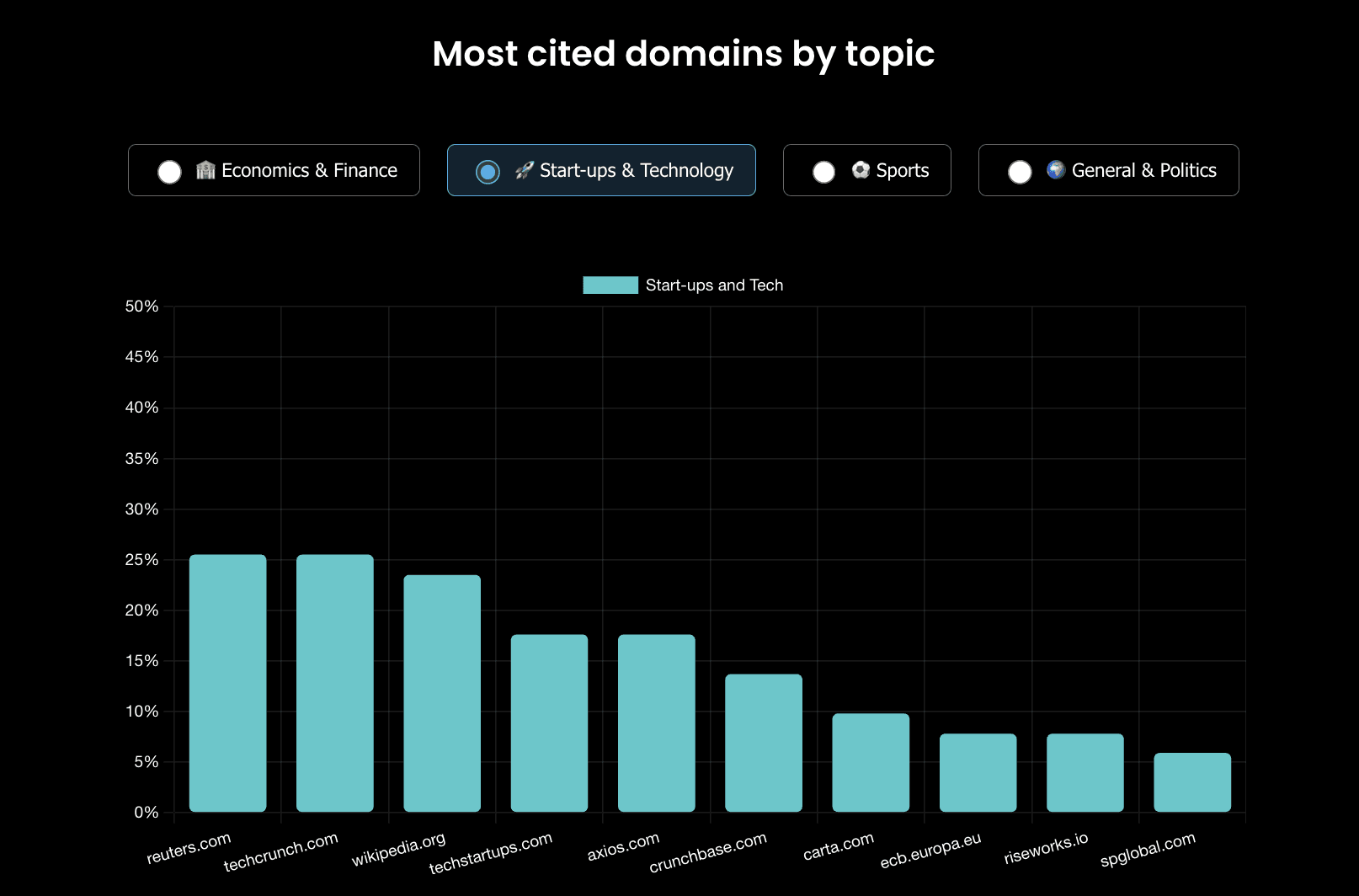

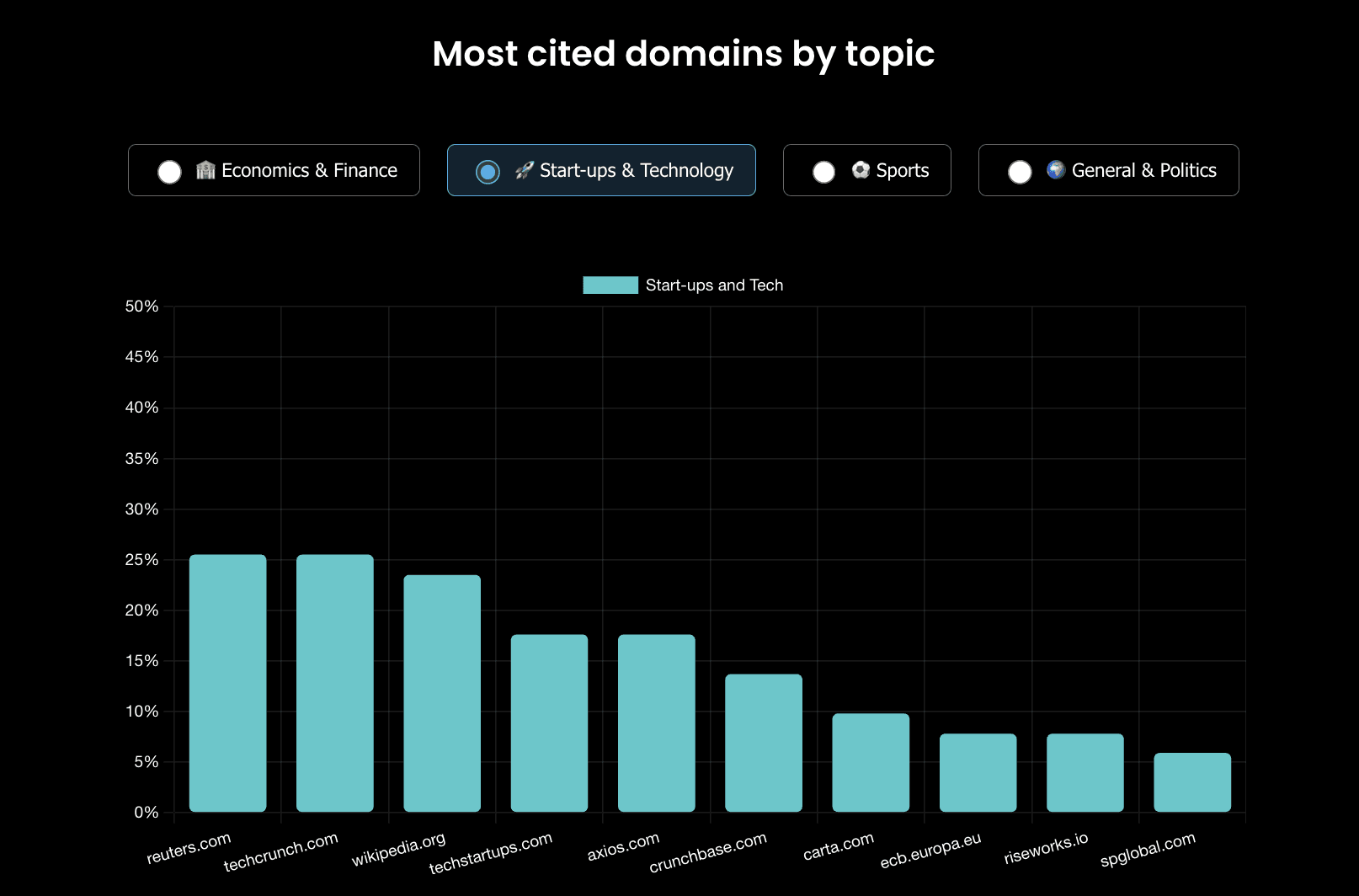

Start-ups & Technology

Reuters and TechCrunch tie at 25.5% (Reuters down from 26.8%, TechCrunch up from 14.6%), demonstrating that specialized technology publishers can match wire services in their category.

Wikipedia maintains 23.5% (up from 17.1%), showing strong presence for technical background and company information.

Techstartups.com achieves 17.6% (unchanged from 17.1%), establishing consistent visibility in technology startup coverage.

Axios reaches 17.6% in this category (up from combined 4.2% overall), indicating significant category specialization compared to its general performance.

Crunchbase captures 13.7% (up from 12.2%), while Carta reaches 9.8% (unchanged), showing that data-focused technology sources maintain steady citation rates.

Key Takeaway: Technology coverage shows the most balanced distribution across source types, with wire services, specialized tech publishers, and data sources each capturing significant citation share. The strong performance of category specialists like TechCrunch and techstartups.com demonstrates that focused editorial coverage can achieve visibility equivalent to general news organizations in specific domains.

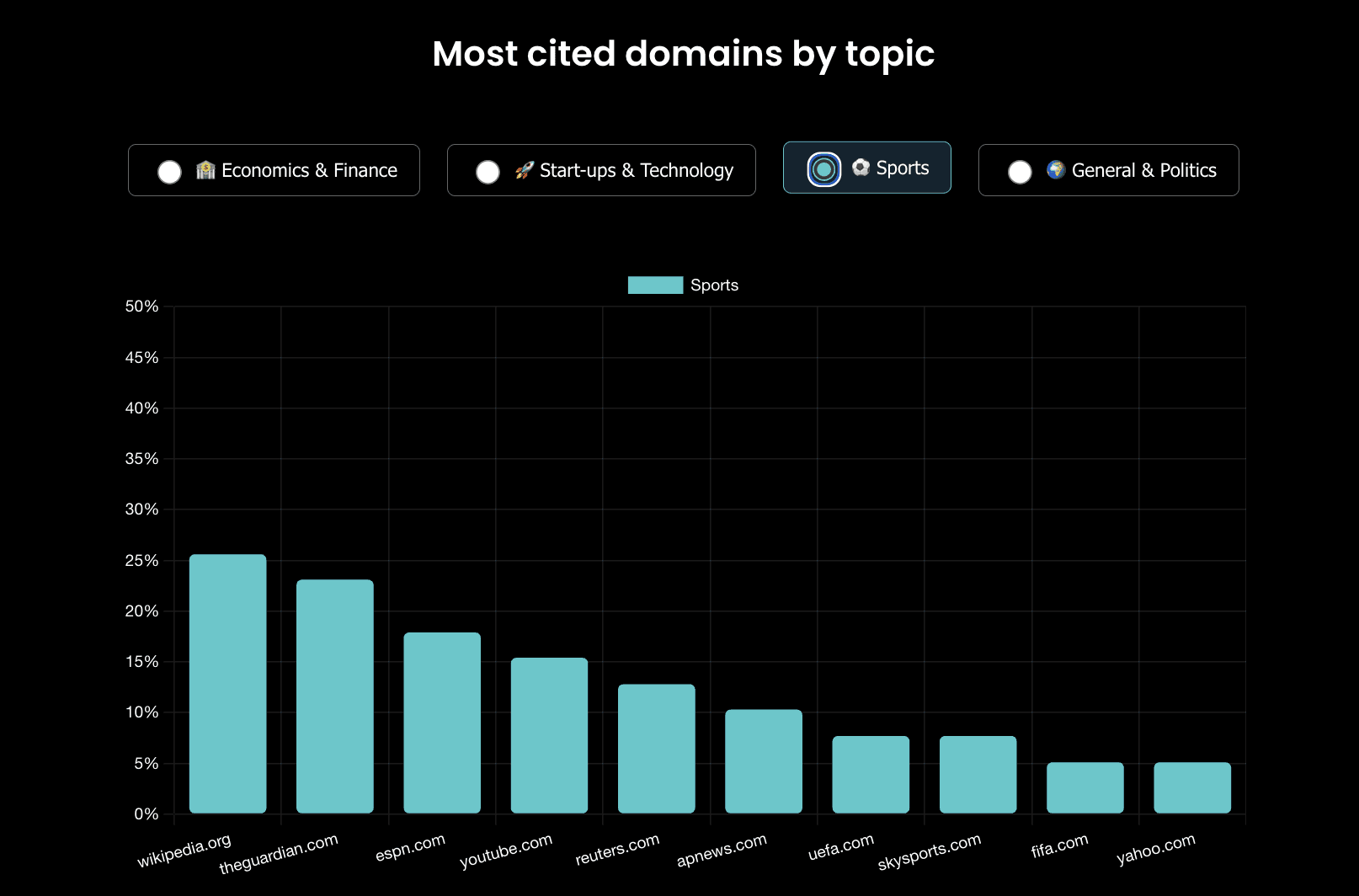

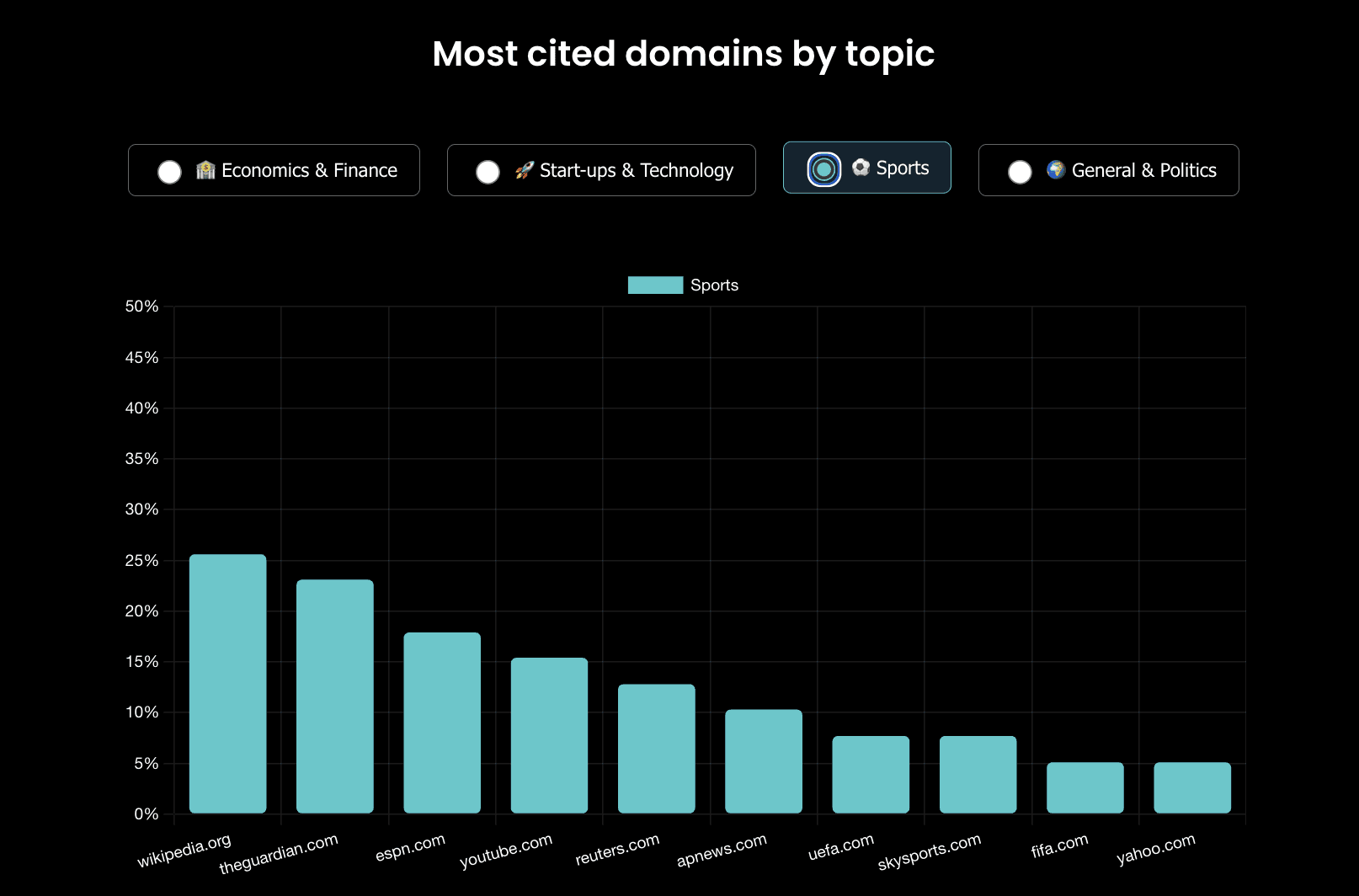

Sports

Wikipedia leads with 25.6% (up from 22.9%), reflecting its utility for sports statistics, team information, and historical data.

The Guardian achieves 23.1% (up substantially from 8.6%), indicating strong week-over-week growth in sports coverage visibility.

ESPN reaches 17.9%, maintaining consistent presence in sports coverage.

YouTube captures 15.4% (up from 11.4%), demonstrating increasing acceptance of video content for sports information and highlights.

Reuters shows 12.8% in sports (down from 31.4%), indicating significantly reduced presence in this category compared to the previous week.

UEFA (7.7%) and Sky Sports (7.7%) maintain specialist positions, while FIFA shows 5.1% (down from 8.6%) for official sports organization content.

Key Takeaway: Sports coverage reflects the most diverse source mix, with reference material (Wikipedia), traditional publishers (Guardian, ESPN), video content (YouTube), and official organizations all achieving notable citation rates. The substantial increase in Guardian sports citations and decline in Reuters may reflect specific sporting events or coverage patterns during the measurement period rather than longer-term platform preferences.

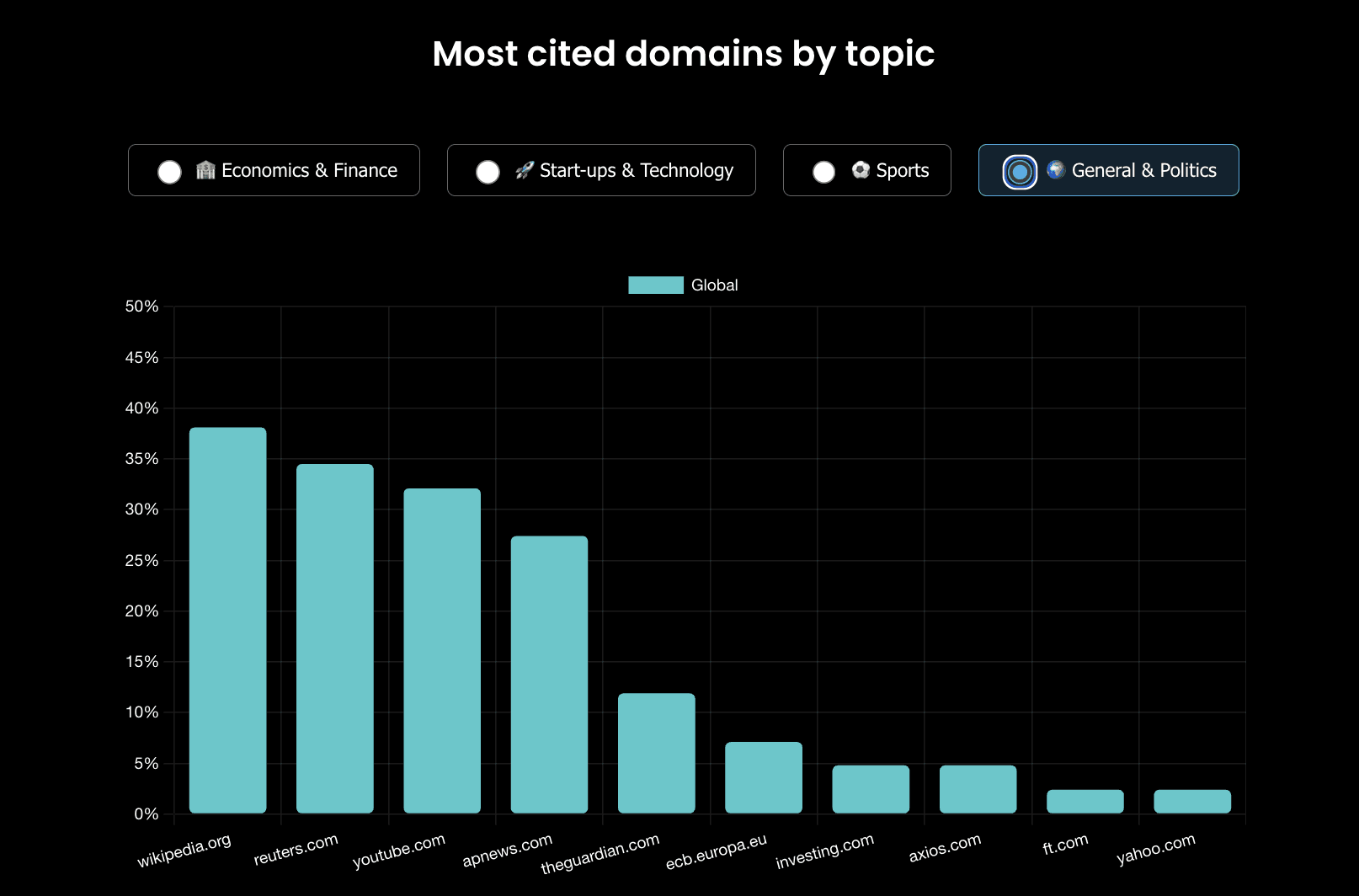

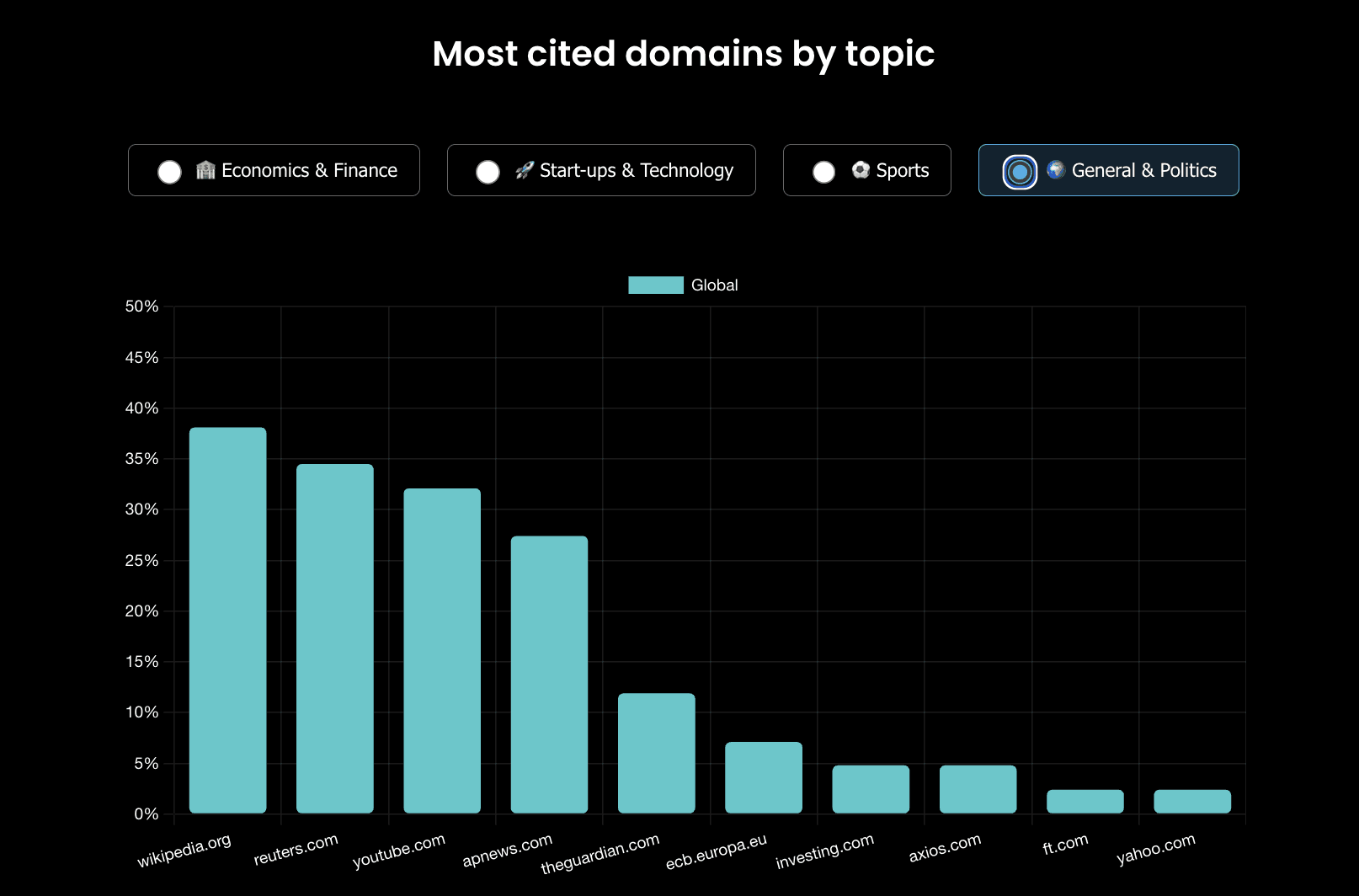

General News & Politics

Wikipedia leads with 38.1% (down from 44.0%), maintaining its position as the primary reference source for political and biographical information.

Reuters captures 34.5% (down from 46.7%), showing reduced but still substantial presence in general news citations.

YouTube reaches 32.1% (up from 29.3%), demonstrating strong performance for video news content in general topics.

AP News maintains 27.4% (down slightly from 29.3%), showing stable wire service presence in general news coverage.

The Guardian achieves 11.9% (down from 14.7%), while ECB appears at 7.1% (down from 8.0%) for relevant policy topics.

Key Takeaway: General news and politics shows the highest overall citation rates, with multiple sources exceeding 30% and indicating that platforms draw from broader source sets for general interest topics. The presence of both reference material (Wikipedia) and video content (YouTube) at comparable rates to wire services suggests that AI platforms recognize different content formats serve different informational needs within general news responses.

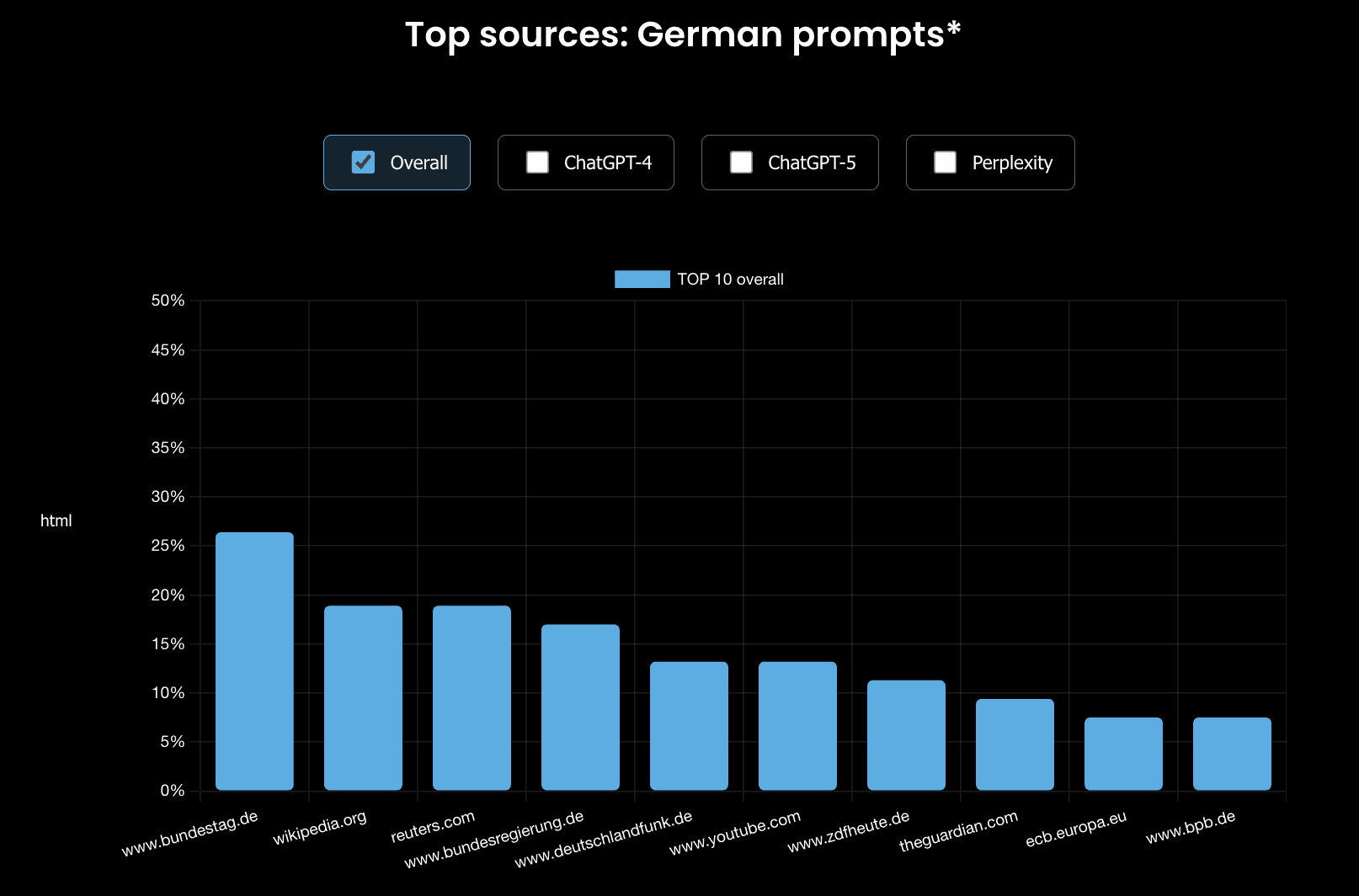

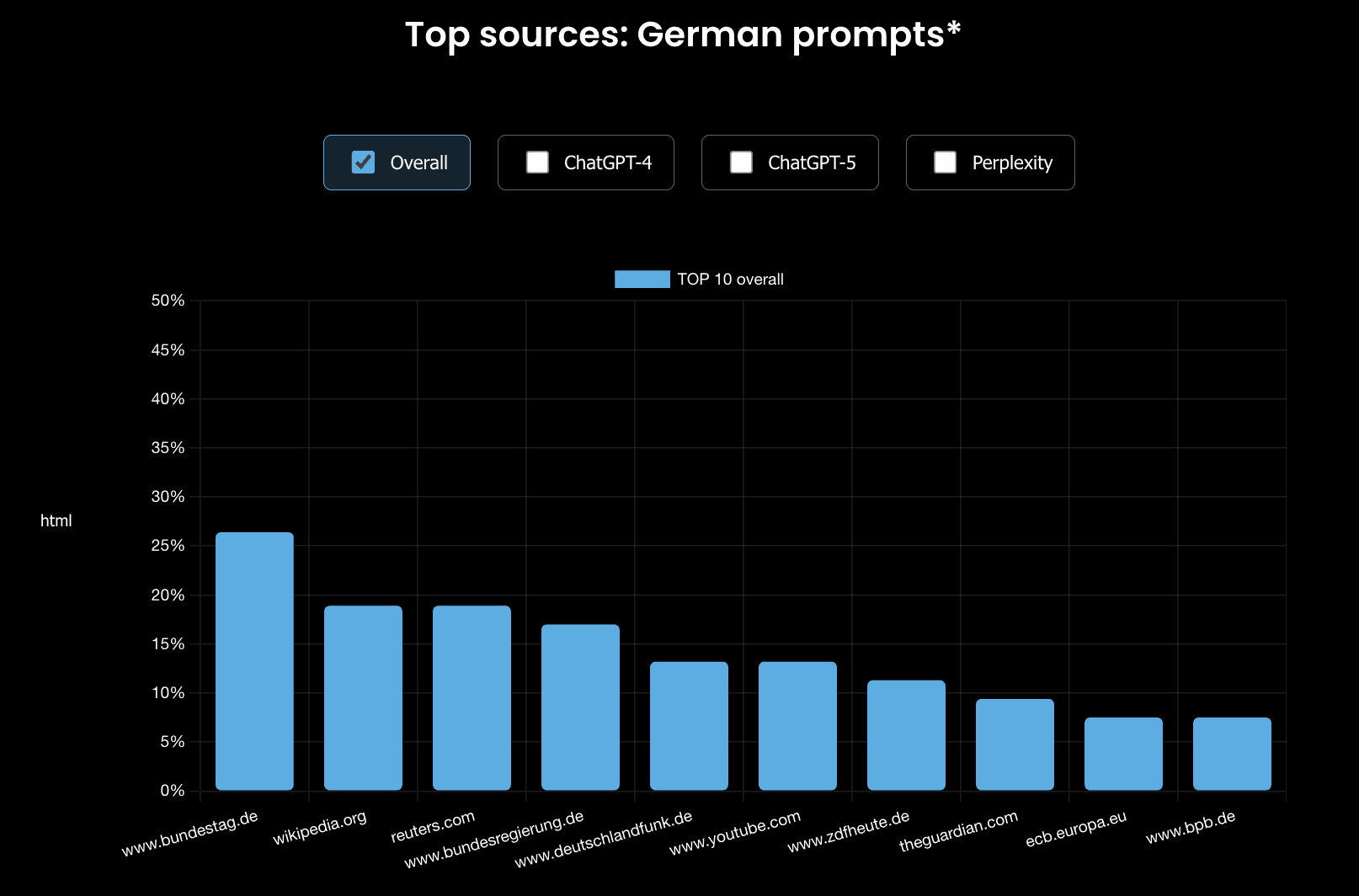

Regional Analysis: German-Language Queries

German-language queries demonstrate markedly different citation patterns from English-language results, with institutional government sources achieving higher visibility than commercial media outlets.

German Market Source Distribution

Bundestag (German Parliament) leads with 26.4% overall (down from 31.7%), showing reduced but still dominant presence as a primary institutional source.

Reuters maintains 18.9% in German queries (down slightly from 19.5%), demonstrating wire service relevance across language markets.

Wikipedia achieves 18.9% (down from 22.0%), maintaining reference utility in German-language responses.

Bundesregierung (Federal Government) captures 17.0% (down from 22.0%), reflecting strong institutional source presence.

Deutschlandfunk reaches 13.2% (up slightly from 12.2%), while YouTube also achieves 13.2% (up from 9.8%), showing public broadcaster and video content strength.

ZDF Heute maintains 11.3% (unchanged from 12.2%), demonstrating consistent public broadcaster presence.

The Guardian appears at 9.4% (up from 7.3%) even in German queries, indicating cross-language citation for international perspectives.

Platform Variations in German Market

ChatGPT-5 demonstrates strongest Reuters presence at 55.6% (up from 50.0%), with Bundestag at 22.2% (down from 35.7%) and The Guardian at 27.8% (up from 0.0% in top 10).

Perplexity favors institutional sources with Bundestag at 38.9% (down from 50.0%) and Bundesregierung at 27.8% (down from 42.9%), while Deutschlandfunk and YouTube each reach 33.3% (up from 28.6%).

Key Takeaway: German-language queries reveal platform preferences that differ substantially from English-language patterns, with government institutional sources capturing citation rates that exceed most commercial media. This pattern likely reflects both the authoritative nature of government sources for political and policy information and potentially different training data distributions across languages. Commercial German publishers like Zeit (5.7%), Tagesspiegel (5.7%), and Welt (5.7%) show modest presence, suggesting opportunities for German-language publishers to increase AI search visibility.

Learnings and Strategic Implications from this weeks findings

Category Specialization Value

Again, this week's data reinforces that specialized publishers can achieve citation rates comparable to wire services within their domains, though overall presence remains more challenging.

TechCrunch's 25.5% in technology topics demonstrates that focused editorial coverage matches Reuters' presence in this category, suggesting category authority can compensate for broader newsroom scale.

Financial Times' 16.1% through specialized cryptocurrency coverage and Investing.com's 16.1% show that subject-matter expertise generates citations in relevant topic areas.

Institutional sources like ECB (12.9%), OECD (12.9%), and IMF (9.7%) in economics demonstrate that authoritative domain expertise maintains citation presence.

ESPN's consistent 17.9% in sports coverage indicates that category-leading publishers maintain visibility even as general wire service presence fluctuates.

The appearance of smaller specialized sources like techstartups.com (17.6%) and news.crunchbase.com (13.7%) suggests that niche publishers with strong category focus can achieve meaningful AI search presence.

Key Takeaway: Publishers with deep category expertise and consistent coverage in specific domains achieve citation rates that compete with general news organizations within those categories. However, this advantage doesn't translate to overall presence across all topics, indicating that publishers must either pursue category dominance or maintain broad coverage across multiple domains to achieve consistent AI search visibility.

Week-Over-Week Volatility and News Cycles

The substantial changes between weeks highlight that AI search citation patterns reflect underlying news cycles and content availability, not just algorithmic preferences.

Reuters' decline from 65.0% to 35.5% in Economics & Finance, while dramatic, may reflect this week's economic news mix rather than fundamental platform changes, suggesting publishers should observe patterns over multiple weeks before drawing strategic conclusions.

The Guardian's increase from 8.6% to 23.1% in sports coverage likely corresponds to specific sporting events where The Guardian provided distinctive coverage, demonstrating how timely, comprehensive reporting can capture citation spikes.

YouTube's growth from 11.4% to 15.4% in sports and from 29.3% to 32.1% in general news suggests either platform algorithm adjustments toward video content or reflects weeks with significant visual news events.

The more stable performance of institutional sources like ECB and OECD (despite some decline) suggests that evergreen authoritative content maintains more consistent citation presence than breaking news coverage.

Key Takeaway: Publishers should interpret week-over-week changes carefully, recognizing that citation patterns reflect both platform behaviors and the news environment. Single-week observations, particularly large swings, may indicate which content strategies captured specific news moments rather than sustainable visibility advantages. Consistent presence across multiple weeks provides better insight into platform preferences than any single measurement period.

Conclusion

This week's AI search citation patterns reveal a more distributed source landscape compared to previous measurements, with reduced concentration around single publishers and increased representation across wire services, specialists, and institutional sources. The notable week-over-week changes, particularly Reuters' decline in economics coverage and The Guardian's surge in sports. demonstrate how citation patterns reflect both platform preferences and underlying news cycles.

For publishers, the data indicates that category specialization provides a viable path to AI search visibility within specific domains, even as overall presence across all topics remains challenging for non-wire services. The substantial differences between platforms and language markets underscore that AI search optimization requires multi-platform strategies rather than focusing on any single model. Organizations like ALLMO.ai provide ongoing monitoring of these patterns, helping publishers understand where their content gains traction and where opportunities for increased visibility exist across the evolving AI search landscape.

AI Search Weekly: Publisher Visibility Report

As AI-powered search platforms continue to reshape how users discover information, understanding citation patterns across different models has become essential for publishers. This week's analysis from ALLMO.ai reveals notable shifts in source selection across ChatGPT-4, ChatGPT-5, and Perplexity, with particular patterns emerging across different content categories and geographic markets.

Read more about the methodology and see the full data at allmo.ai/trends

Top 3 Highlights towards the end of the year

1. Reuters Maintains Strong Position Despite Notable Decline

Reuters captures 35.5% of citations in Economics & Finance this week, down from the previous week, a substantial decrease that repositions it closer to other leading sources. While Reuters remains the category leader, this 29.5 percentage point reduction indicates increased citation diversity, with institutional sources like ECB (12.9%) and Financial Times (16.1%) gaining more balanced representation in financial topic responses.

2. Wikipedia Shows Consistent Cross-Platform Presence with Modest Decline

Wikipedia maintains 38.1% citation rate in General News & Politics (down from 44.0%), demonstrating its continued role as a reference source across AI platforms. The source achieves relatively balanced performance across all categories—ranging from 12.9% in Economics to 25.6% in Sports—reflecting its utility for background information and statistical data, though the slight decline suggests platforms may be diversifying their reference material citations.

3. TechCrunch Increases Visibility in Technology Coverage

TechCrunch reaches 25.5% citation rate in Start-ups & Technology topics, equal to Reuters in this category and demonstrating the value of category specialization. This maintains TechCrunch's position as a leading technology publisher alongside emerging sources like techstartups.com (17.6%) and Axios (17.6%), indicating that specialized publishers can achieve visibility comparable to general news wire services within their domains.

Overall Platform Performance

This week's data reveals distinct citation patterns across the three major AI search platforms, with each showing different preferences for source types and formats. Reuters and Wikipedia emerge as the most consistently cited sources, though their performance varies significantly by platform.

Top Sources Across All Platforms

Reuters leads overall with 35.5% in Economics & Finance and 34.5% in General News & Politics (down from 65.0% and 46.7% respectively), indicating reduced but still substantial presence across major news categories.

Wikipedia shows strong cross-category performance at 38.1% in General News & Politics (down from 44.0%), 25.6% in Sports, and 23.5% in Technology, demonstrating consistent utility across topic areas.

AP News maintains 27.4% citation rate in General News & Politics (down from 29.3%) and 19.4% in Economics & Finance (up from 15.0%), showing relative stability as a wire service source.

YouTube demonstrates significant presence at 32.1% in General News & Politics (up from 29.3%) and 15.4% in Sports (up from 11.4%), reflecting growing acceptance of video content in AI citations.

The Guardian appears across multiple categories with 23.1% in Sports (up from 8.6%) and 11.9% in General News & Politics (down from 14.7%), indicating category-specific strength variations.

Key Takeaway: The overall citation landscape shows reduced concentration compared to the previous week, with Reuters declining from its previously dominant position while other sources gain more balanced representation. This pattern suggests either a shift in platform algorithms toward citation diversity or reflects the influence of different news cycles, though the changes are substantial enough to merit publisher attention. Sources maintaining consistent presence across multiple categories indicate broader editorial relevance to AI platforms.

Category-Specific Patterns

Different content categories show markedly different citation patterns, with specialized publishers performing particularly well in their domains while wire services maintain cross-category strength.

Economics & Finance

Reuters leads with 35.5% (down substantially from 65.0%), indicating reduced concentration in financial topic citations while maintaining category leadership.

AP News shows 19.4% citation rate (up from 15.0%), suggesting increased reliance on this wire service for economic news coverage.

Financial Times reaches 16.1% through its cryptoreset subdomain (up from 3.5%), demonstrating strength in specialized financial coverage with notable growth.

Investing.com maintains 16.1% (down from 20.0%), showing relatively stable presence as a financial information specialist.

European Central Bank appears at 12.9% (down from 25.0%), reflecting reduced but continued citation of institutional economic sources.

OECD (12.9%), IMF (9.7%), and S&P Global (9.7%) demonstrate that institutional and analytical sources maintain significant presence alongside news publishers.

Key Takeaway: Economics & Finance shows the most dramatic shift from last week, with Reuters declining from nearly two-thirds of citations to roughly one-third. This redistribution benefits both other wire services and institutional sources, creating a more balanced citation environment. The pattern may reflect the week's economic news mix favoring diverse source types, or could indicate platform adjustments toward representing multiple perspectives on financial topics.

Start-ups & Technology

Reuters and TechCrunch tie at 25.5% (Reuters down from 26.8%, TechCrunch up from 14.6%), demonstrating that specialized technology publishers can match wire services in their category.

Wikipedia maintains 23.5% (up from 17.1%), showing strong presence for technical background and company information.

Techstartups.com achieves 17.6% (unchanged from 17.1%), establishing consistent visibility in technology startup coverage.

Axios reaches 17.6% in this category (up from combined 4.2% overall), indicating significant category specialization compared to its general performance.

Crunchbase captures 13.7% (up from 12.2%), while Carta reaches 9.8% (unchanged), showing that data-focused technology sources maintain steady citation rates.

Key Takeaway: Technology coverage shows the most balanced distribution across source types, with wire services, specialized tech publishers, and data sources each capturing significant citation share. The strong performance of category specialists like TechCrunch and techstartups.com demonstrates that focused editorial coverage can achieve visibility equivalent to general news organizations in specific domains.

Sports

Wikipedia leads with 25.6% (up from 22.9%), reflecting its utility for sports statistics, team information, and historical data.

The Guardian achieves 23.1% (up substantially from 8.6%), indicating strong week-over-week growth in sports coverage visibility.

ESPN reaches 17.9%, maintaining consistent presence in sports coverage.

YouTube captures 15.4% (up from 11.4%), demonstrating increasing acceptance of video content for sports information and highlights.

Reuters shows 12.8% in sports (down from 31.4%), indicating significantly reduced presence in this category compared to the previous week.

UEFA (7.7%) and Sky Sports (7.7%) maintain specialist positions, while FIFA shows 5.1% (down from 8.6%) for official sports organization content.

Key Takeaway: Sports coverage reflects the most diverse source mix, with reference material (Wikipedia), traditional publishers (Guardian, ESPN), video content (YouTube), and official organizations all achieving notable citation rates. The substantial increase in Guardian sports citations and decline in Reuters may reflect specific sporting events or coverage patterns during the measurement period rather than longer-term platform preferences.

General News & Politics

Wikipedia leads with 38.1% (down from 44.0%), maintaining its position as the primary reference source for political and biographical information.

Reuters captures 34.5% (down from 46.7%), showing reduced but still substantial presence in general news citations.

YouTube reaches 32.1% (up from 29.3%), demonstrating strong performance for video news content in general topics.

AP News maintains 27.4% (down slightly from 29.3%), showing stable wire service presence in general news coverage.

The Guardian achieves 11.9% (down from 14.7%), while ECB appears at 7.1% (down from 8.0%) for relevant policy topics.

Key Takeaway: General news and politics shows the highest overall citation rates, with multiple sources exceeding 30% and indicating that platforms draw from broader source sets for general interest topics. The presence of both reference material (Wikipedia) and video content (YouTube) at comparable rates to wire services suggests that AI platforms recognize different content formats serve different informational needs within general news responses.

Regional Analysis: German-Language Queries

German-language queries demonstrate markedly different citation patterns from English-language results, with institutional government sources achieving higher visibility than commercial media outlets.

German Market Source Distribution

Bundestag (German Parliament) leads with 26.4% overall (down from 31.7%), showing reduced but still dominant presence as a primary institutional source.

Reuters maintains 18.9% in German queries (down slightly from 19.5%), demonstrating wire service relevance across language markets.

Wikipedia achieves 18.9% (down from 22.0%), maintaining reference utility in German-language responses.

Bundesregierung (Federal Government) captures 17.0% (down from 22.0%), reflecting strong institutional source presence.

Deutschlandfunk reaches 13.2% (up slightly from 12.2%), while YouTube also achieves 13.2% (up from 9.8%), showing public broadcaster and video content strength.

ZDF Heute maintains 11.3% (unchanged from 12.2%), demonstrating consistent public broadcaster presence.

The Guardian appears at 9.4% (up from 7.3%) even in German queries, indicating cross-language citation for international perspectives.

Platform Variations in German Market

ChatGPT-5 demonstrates strongest Reuters presence at 55.6% (up from 50.0%), with Bundestag at 22.2% (down from 35.7%) and The Guardian at 27.8% (up from 0.0% in top 10).

Perplexity favors institutional sources with Bundestag at 38.9% (down from 50.0%) and Bundesregierung at 27.8% (down from 42.9%), while Deutschlandfunk and YouTube each reach 33.3% (up from 28.6%).

Key Takeaway: German-language queries reveal platform preferences that differ substantially from English-language patterns, with government institutional sources capturing citation rates that exceed most commercial media. This pattern likely reflects both the authoritative nature of government sources for political and policy information and potentially different training data distributions across languages. Commercial German publishers like Zeit (5.7%), Tagesspiegel (5.7%), and Welt (5.7%) show modest presence, suggesting opportunities for German-language publishers to increase AI search visibility.

Learnings and Strategic Implications from this weeks findings

Category Specialization Value

Again, this week's data reinforces that specialized publishers can achieve citation rates comparable to wire services within their domains, though overall presence remains more challenging.

TechCrunch's 25.5% in technology topics demonstrates that focused editorial coverage matches Reuters' presence in this category, suggesting category authority can compensate for broader newsroom scale.

Financial Times' 16.1% through specialized cryptocurrency coverage and Investing.com's 16.1% show that subject-matter expertise generates citations in relevant topic areas.

Institutional sources like ECB (12.9%), OECD (12.9%), and IMF (9.7%) in economics demonstrate that authoritative domain expertise maintains citation presence.

ESPN's consistent 17.9% in sports coverage indicates that category-leading publishers maintain visibility even as general wire service presence fluctuates.

The appearance of smaller specialized sources like techstartups.com (17.6%) and news.crunchbase.com (13.7%) suggests that niche publishers with strong category focus can achieve meaningful AI search presence.

Key Takeaway: Publishers with deep category expertise and consistent coverage in specific domains achieve citation rates that compete with general news organizations within those categories. However, this advantage doesn't translate to overall presence across all topics, indicating that publishers must either pursue category dominance or maintain broad coverage across multiple domains to achieve consistent AI search visibility.

Week-Over-Week Volatility and News Cycles

The substantial changes between weeks highlight that AI search citation patterns reflect underlying news cycles and content availability, not just algorithmic preferences.

Reuters' decline from 65.0% to 35.5% in Economics & Finance, while dramatic, may reflect this week's economic news mix rather than fundamental platform changes, suggesting publishers should observe patterns over multiple weeks before drawing strategic conclusions.

The Guardian's increase from 8.6% to 23.1% in sports coverage likely corresponds to specific sporting events where The Guardian provided distinctive coverage, demonstrating how timely, comprehensive reporting can capture citation spikes.

YouTube's growth from 11.4% to 15.4% in sports and from 29.3% to 32.1% in general news suggests either platform algorithm adjustments toward video content or reflects weeks with significant visual news events.

The more stable performance of institutional sources like ECB and OECD (despite some decline) suggests that evergreen authoritative content maintains more consistent citation presence than breaking news coverage.

Key Takeaway: Publishers should interpret week-over-week changes carefully, recognizing that citation patterns reflect both platform behaviors and the news environment. Single-week observations, particularly large swings, may indicate which content strategies captured specific news moments rather than sustainable visibility advantages. Consistent presence across multiple weeks provides better insight into platform preferences than any single measurement period.

Conclusion

This week's AI search citation patterns reveal a more distributed source landscape compared to previous measurements, with reduced concentration around single publishers and increased representation across wire services, specialists, and institutional sources. The notable week-over-week changes, particularly Reuters' decline in economics coverage and The Guardian's surge in sports. demonstrate how citation patterns reflect both platform preferences and underlying news cycles.

For publishers, the data indicates that category specialization provides a viable path to AI search visibility within specific domains, even as overall presence across all topics remains challenging for non-wire services. The substantial differences between platforms and language markets underscore that AI search optimization requires multi-platform strategies rather than focusing on any single model. Organizations like ALLMO.ai provide ongoing monitoring of these patterns, helping publishers understand where their content gains traction and where opportunities for increased visibility exist across the evolving AI search landscape.

About the author

ALLMO.ai Team

ALLMO.ai helps brands measure and improve their visibility in AI-generated search results like ChatGPT and Perplexity. It provides optimization insights, recommendations to increase your brands visibility, and URL warm-up to get new content crawled and discovered faster.

Check out more articles

Start your AI Search Optimization journey today!

Applied Large Language Model Optimization (ALLMO), also known as GEO/AEO is gaining strong momentum.