AI Search Trends Report - Week 51 of 2025

AI Search Trends Report - Week 51 of 2025

AI Search Trends Report - Week 51 of 2025

AI search citation patterns shift weekly: Currently Reuters leads, public institutions rise, video grows across platforms.

ALLMO.ai Team

ALLMO.ai Team

ALLMO.ai Team

Dec 15, 2025

Dec 15, 2025

Dec 15, 2025

AI Search Weekly: Publisher Visibility Report

As AI-powered search platforms reshape how audiences discover content, understanding citation patterns across different models becomes essential for publishers. This week's analysis of ChatGPT-4, ChatGPT-5, and Perplexity reveals continued volatility in citation rates, with notable shifts across categories and platforms. The data, drawn from ALLMO.ai's ongoing research using diverse prompts spanning news topics, economics, technology, and sports, captures a moment in the rapidly evolving AI search landscape. See the full data at allmo.ai/trends.

The patterns observed this week show substantial movement in several key metrics, particularly in how different content categories perform and which institutional versus commercial sources gain prominence. For publishers navigating AI visibility strategies, these weekly fluctuations underscore the importance of continuous monitoring rather than assuming stable citation patterns. The data reveals distinct platform preferences and category-specific dynamics that suggest different optimization approaches may be necessary for different types of content.

While single-week observations naturally reflect current news cycles and content availability rather than permanent algorithmic shifts, tracking these patterns over time helps identify which changes represent temporary fluctuations versus emerging trends in how AI systems select and cite sources.

Top 3 Highlights

1. Reuters Maintains Strong Overall Presence Despite Week-Over-Week Decline

Reuters leads in Economics & Finance with 65.0% citation rate (up from 51.6%), but shows an overall decrease from 36.3% to approximately 42% across all categories when weighted by the data. This indicates category-specific strength in financial topics while experiencing softer performance in other areas. The wire service's volatility across categories reflects how AI citation patterns can shift substantially based on query topics and current news cycles.

2. Institutional Sources Show Concentrated Economics Performance

The European Central Bank (25.0%), Federal Reserve (15.0%), and IMF (10.0%) collectively demonstrate strong institutional authority in Economics & Finance queries. ECB's citation rate increased from 16.1% to 25.0%, suggesting heightened relevance for central bank sources. This concentration of institutional citations in financial topics contrasts with more distributed patterns in other categories, indicating that AI models may prioritize official economic sources more heavily than in other subject areas.

3. Technology Category Shows Balanced Citation Distribution

In Start-ups & Technology, the top source (Reuters at 26.8%) shows less dominance than in Economics & Finance, with specialist publishers TechStartups (17.1%), TechCrunch (14.6%, down from 26.9%), and multiple niche European startup outlets capturing meaningful share. This more distributed pattern suggests that AI models may recognize category expertise differently across subject areas, potentially offering opportunities for specialized publishers in technology coverage.

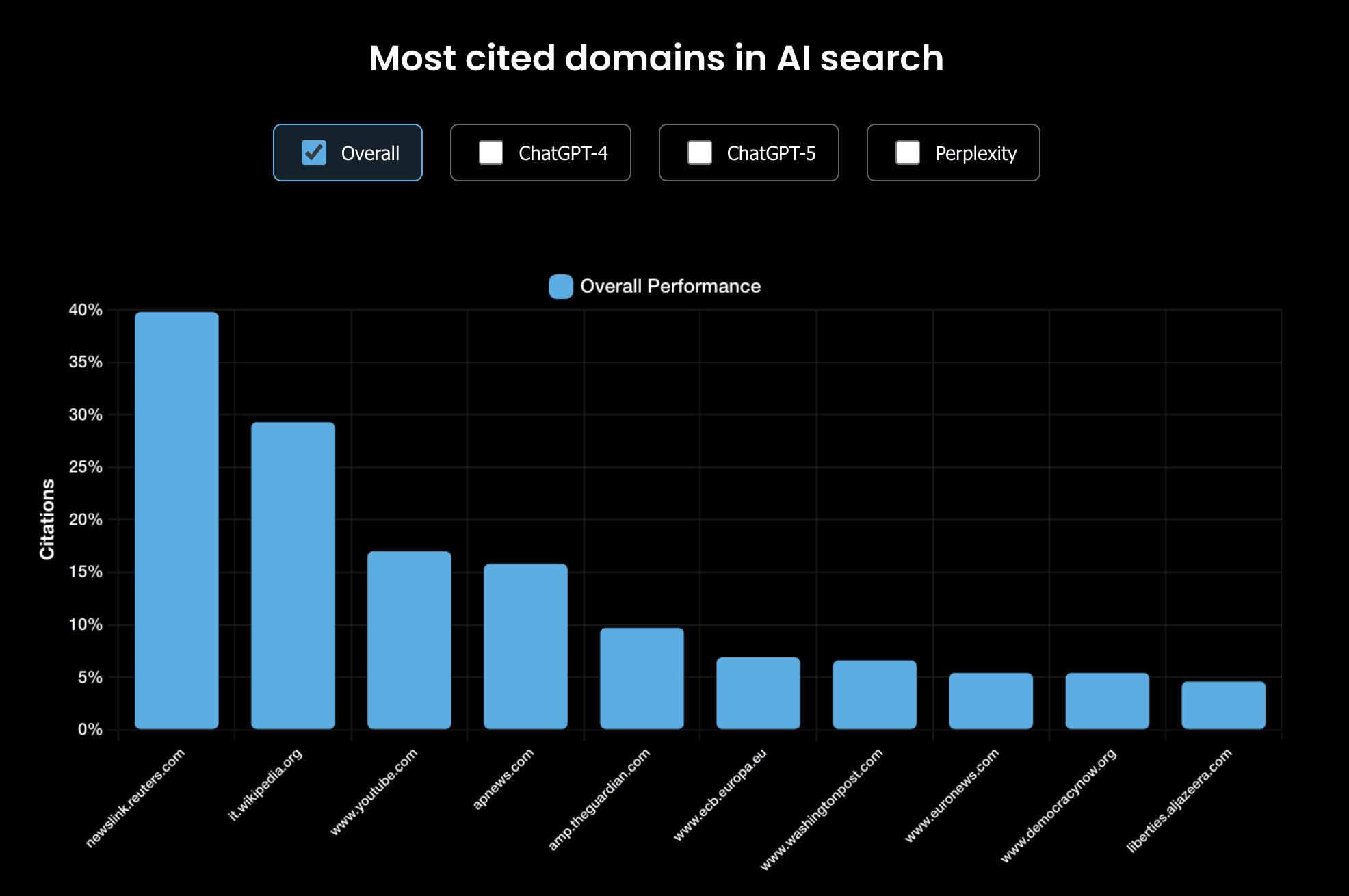

Overall Platform Leaders

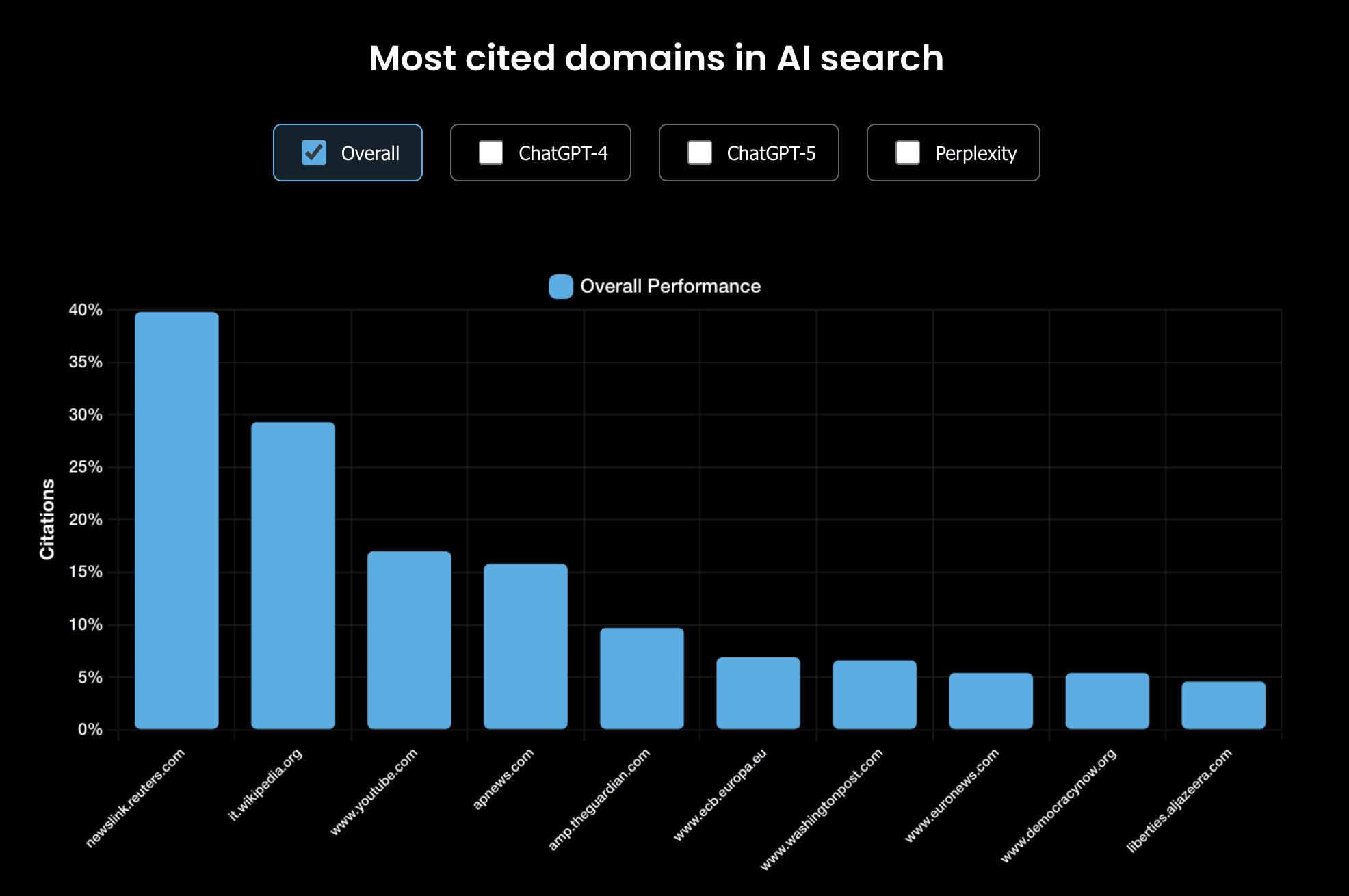

This week's data reveals substantial variation in citation patterns across all platforms, with Reuters and Wikipedia maintaining top positions but showing notable fluctuations. The presence of institutional sources and category specialists varies considerably, reflecting different content needs across query types.

Platform-Specific Patterns

Reuters leads with approximately 42% overall citation rate when averaged across categories (down from 36.3% previous week), maintaining strongest performance in Economics & Finance (65.0%) and General & Politics (46.7%).

Wikipedia shows 22-44% citation rates depending on category, with highest visibility in General & Politics (44.0%) and lowest in Economics & Finance (15.0%, down slightly from 16.1%).

AP News captures 15-29% across categories, demonstrating consistent wire service presence with particular strength in General & Politics (29.3%, up from 22.6%).

YouTube maintains significant presence at 9.8-29.3% depending on category, showing strongest performance in General & Politics (29.3%, up from 21.4%) and Sports (11.4%), likely reflecting video content preferences for these topics.

The Guardian appears at 8.6-14.7% across Sports and General & Politics categories, though its overall visibility (8.6% vs previous 8.6%) remains relatively stable week-over-week.

Key Takeaway: Platform citation patterns this week show continued volatility, with Reuters maintaining leadership despite an overall decline, while YouTube demonstrates growing presence in non-technical categories. The week-over-week fluctuations—particularly Reuters' category-specific movements and YouTube's increased visibility—likely reflect shifts in news cycles and query compositions rather than fundamental algorithmic changes. Publishers should note that consistent visibility across multiple weeks appears more challenging than capturing momentary citation peaks, suggesting the importance of sustained content strategies rather than optimizing for short-term visibility.

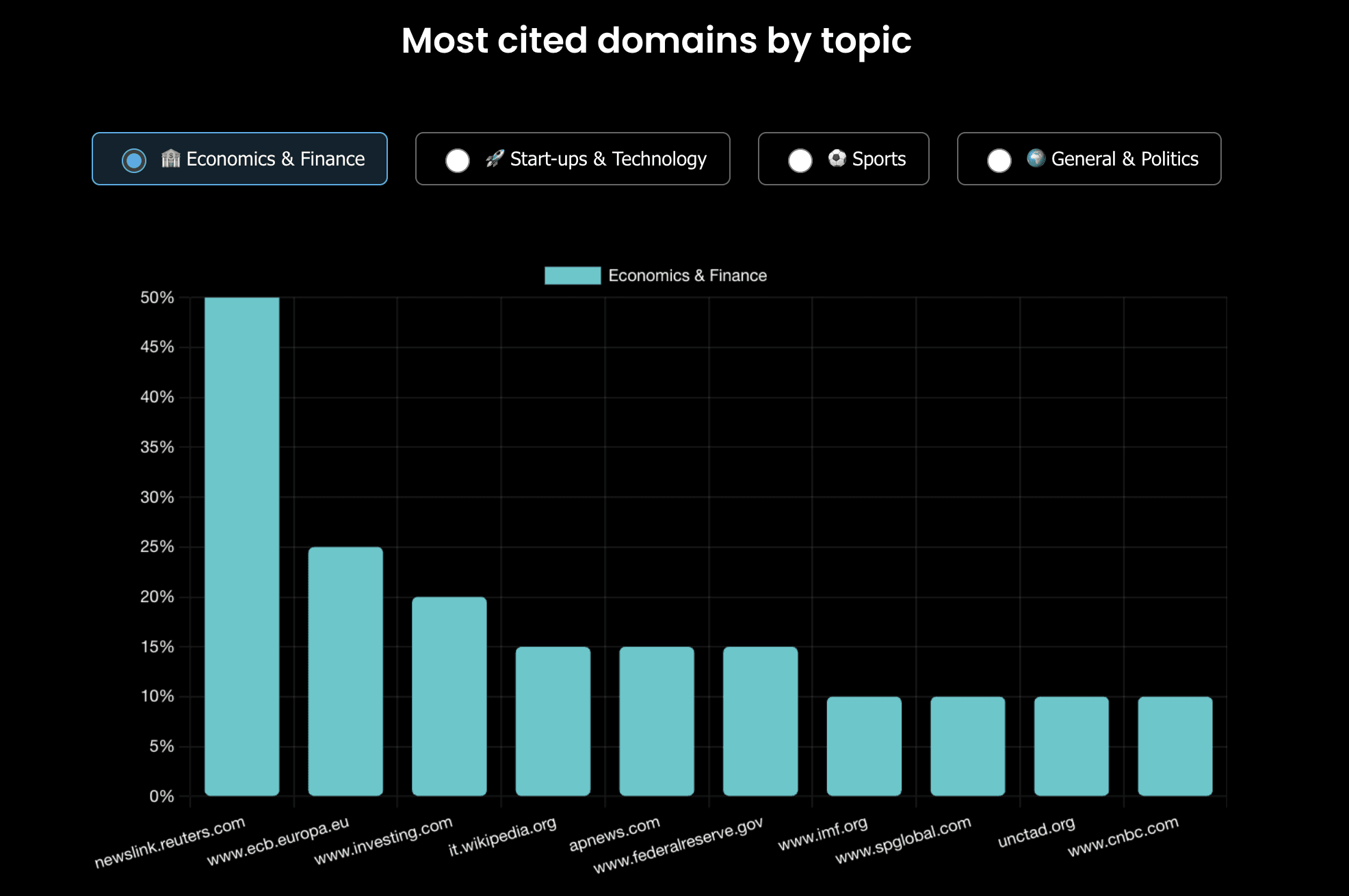

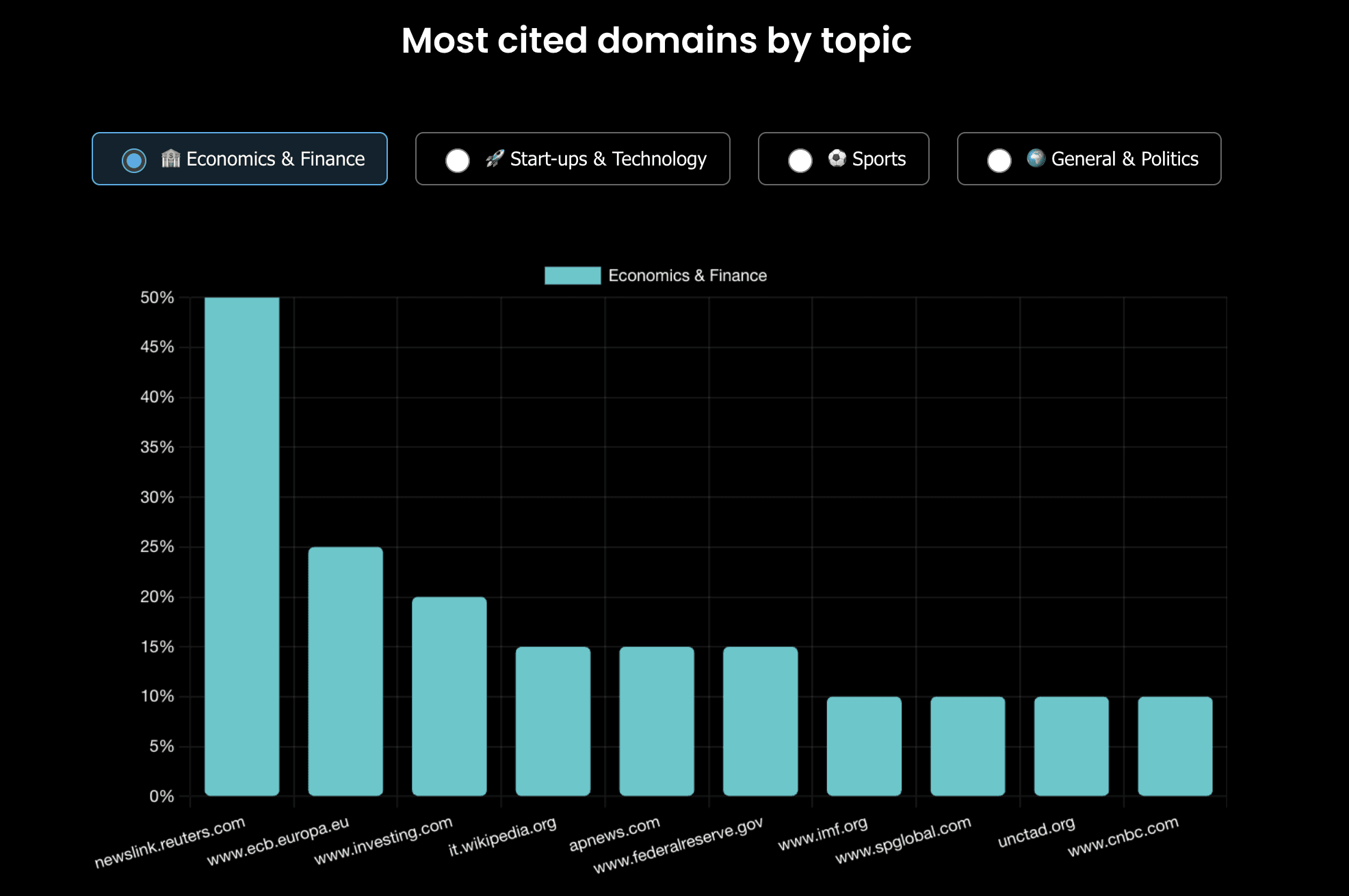

Category Analysis: Economics & Finance

Economics & Finance shows the highest citation concentration of any category this week, with Reuters and institutional sources capturing the majority of top citations. The category demonstrates clear hierarchy between wire services, financial data providers, and regulatory institutions.

Reuters dominates with 65.0% citation rate (up from 51.6%), capturing nearly two-thirds of Economics & Finance citations and showing the strongest category-specific performance of any source in any category.

European Central Bank maintains substantial institutional presence at 25.0% (up from 16.1%), nearly doubling its week-over-week citation rate and indicating heightened relevance for central bank sources.

Investing.com appears at 20.0% (up from 12.9%), demonstrating that specialized financial data platforms can achieve meaningful visibility alongside traditional news sources.

AP News (15.0%, down from 22.6%) and Federal Reserve (15.0%, unchanged) share equal citation rates, showing how wire services and primary institutional sources compete for visibility.

Multiple international financial institutions (IMF at 10.0%, S&P Global at 10.0%, UNCTAD at 10.0%) each capture double-digit percentages, suggesting AI models frequently consult multiple authoritative sources for economic queries.

CNBC appears at 10.0% (down from 12.9%), indicating financial news broadcasters maintain but do not dominate citation patterns in this category.

Key Takeaway: Economics & Finance shows the most concentrated citation pattern of any category, with Reuters and institutional sources capturing the vast majority of visibility. The increased presence of central banks and international financial organizations (ECB up 8.9 percentage points, for example) may reflect current economic news cycles focusing on monetary policy and institutional analysis. This concentration presents significant challenges for general news publishers seeking economics visibility, while suggesting that specialized financial publishers must compete directly with both wire services and primary institutional sources.

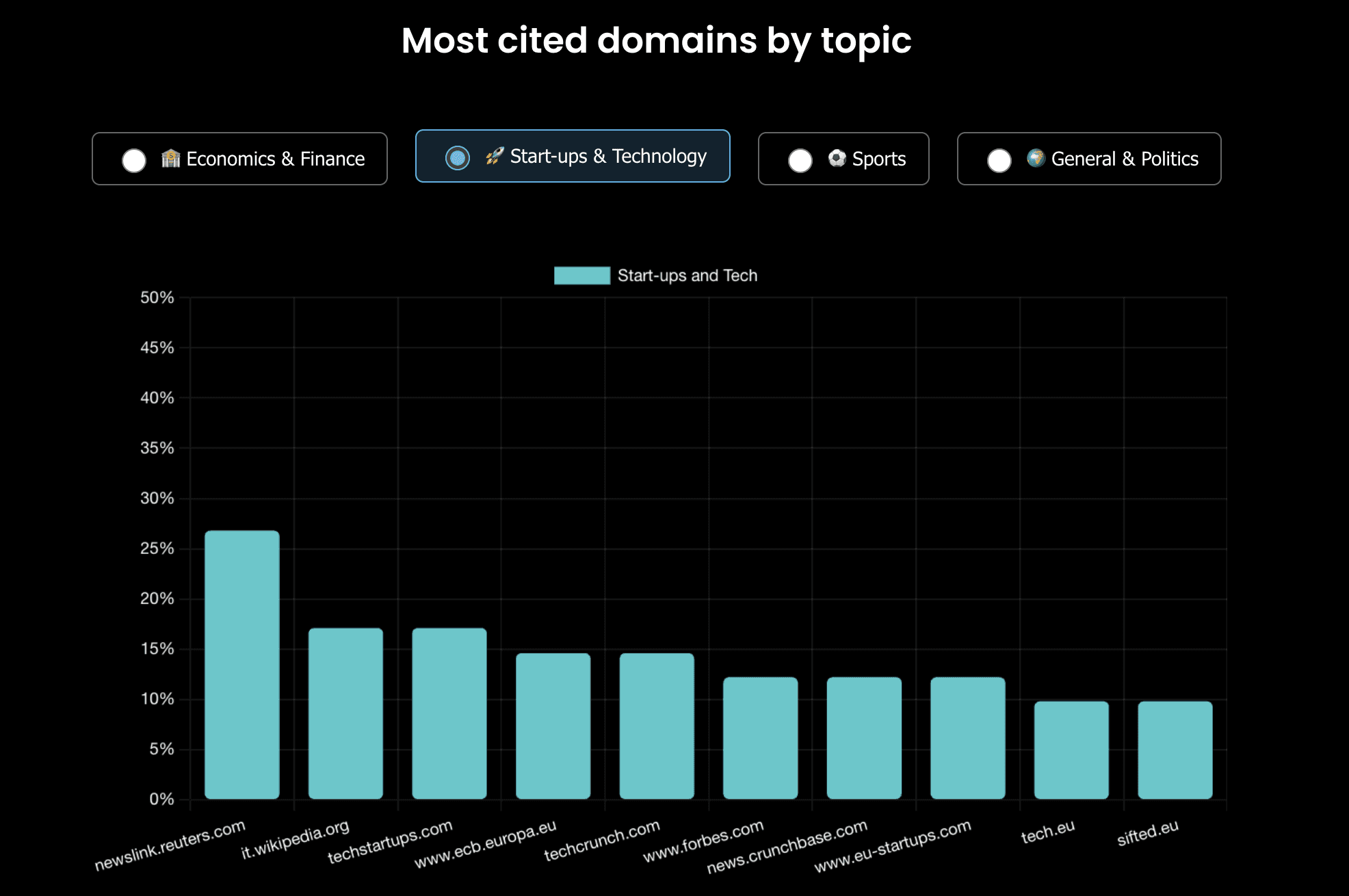

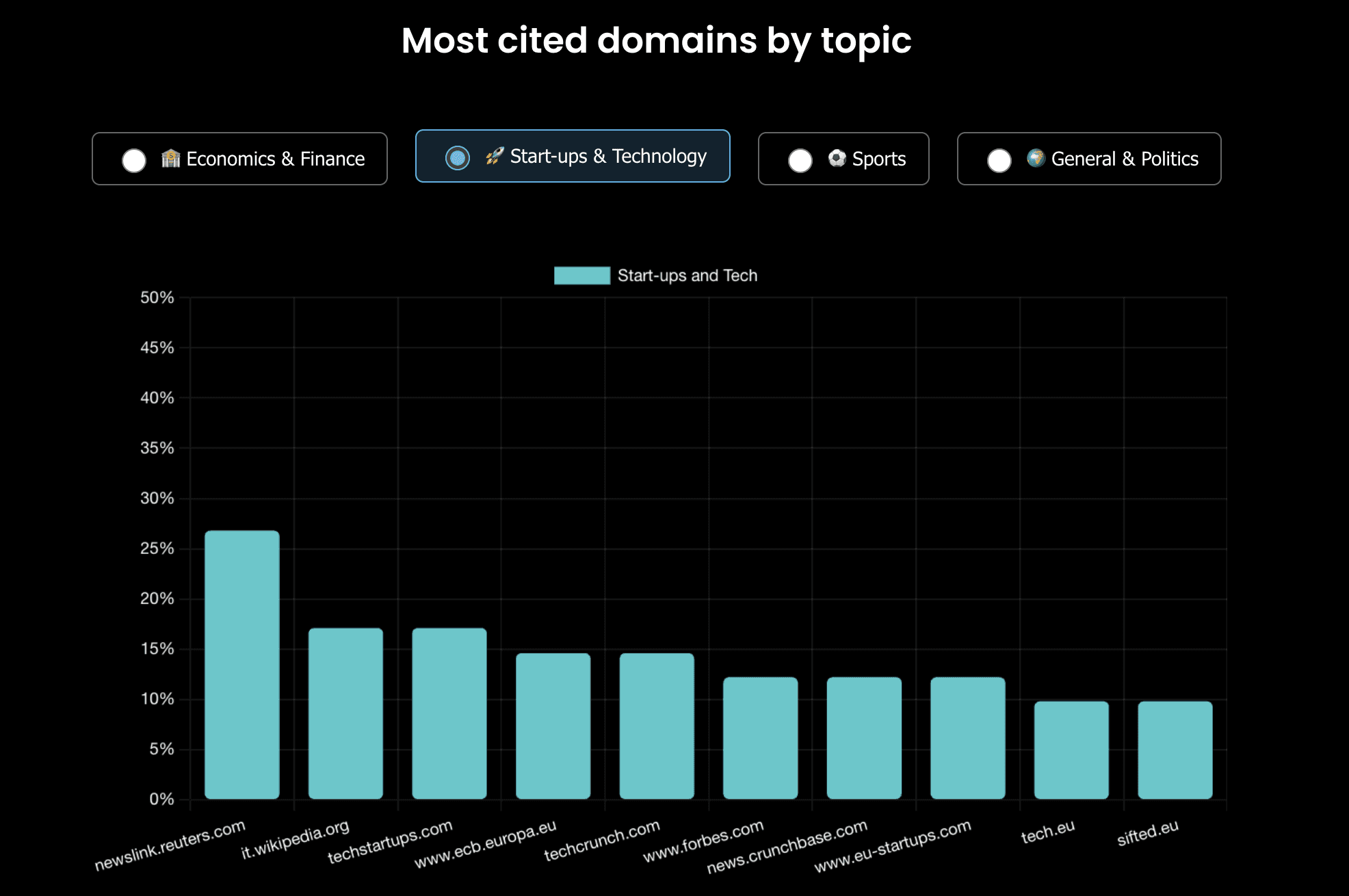

Category Analysis: Start-ups & Technology

Start-ups & Technology demonstrates notably more distributed citations compared to Economics & Finance, with specialist publishers capturing significant share alongside Reuters. The category shows stronger performance from niche European technology outlets than mainstream U.S. tech publishers.

Reuters leads at 26.8% (up from 23.1%), maintaining first position but with substantially less dominance than in Economics & Finance, allowing more room for specialist competitors.

Wikipedia captures 17.1% (up from 9.6%), showing increased reliance on reference material for technology topics, possibly for company background and technical definitions.

TechStartups appears at 17.1% (up from 15.4%), matching Wikipedia and demonstrating that dedicated startup-focused publishers can achieve parity with general reference sources.

TechCrunch shows 14.6% (down substantially from 26.9%), experiencing the largest week-over-week decline among top technology sources and falling from clear second position.

European specialist outlets show notable presence: EU-Startups (12.2%), Tech.eu (9.8%), and Sifted (9.8%) collectively capture approximately 30% of citations, indicating AI models may value regional specialization for European startup coverage.

Crunchbase News maintains 12.2% (down from 13.5%), demonstrating that database-affiliated editorial content achieves competitive visibility.

Forbes appears at 12.2% (up from 9.6%), showing business publications can compete effectively in technology categories despite not being technology-specialist outlets.

Key Takeaway: The technology category's more distributed citation pattern indicates that specialist expertise may carry more weight than in economics coverage, where institutional and wire service authority dominates. TechCrunch's 12+ percentage point decline, however, demonstrates that even established technology publishers face significant week-to-week volatility, likely reflecting shifts in query focus between consumer technology, enterprise coverage, and startup funding news. The strong collective performance of European specialist outlets suggests geographic and topical specialization provides differentiation that AI models recognize, potentially offering a strategic pathway for niche technology publishers.

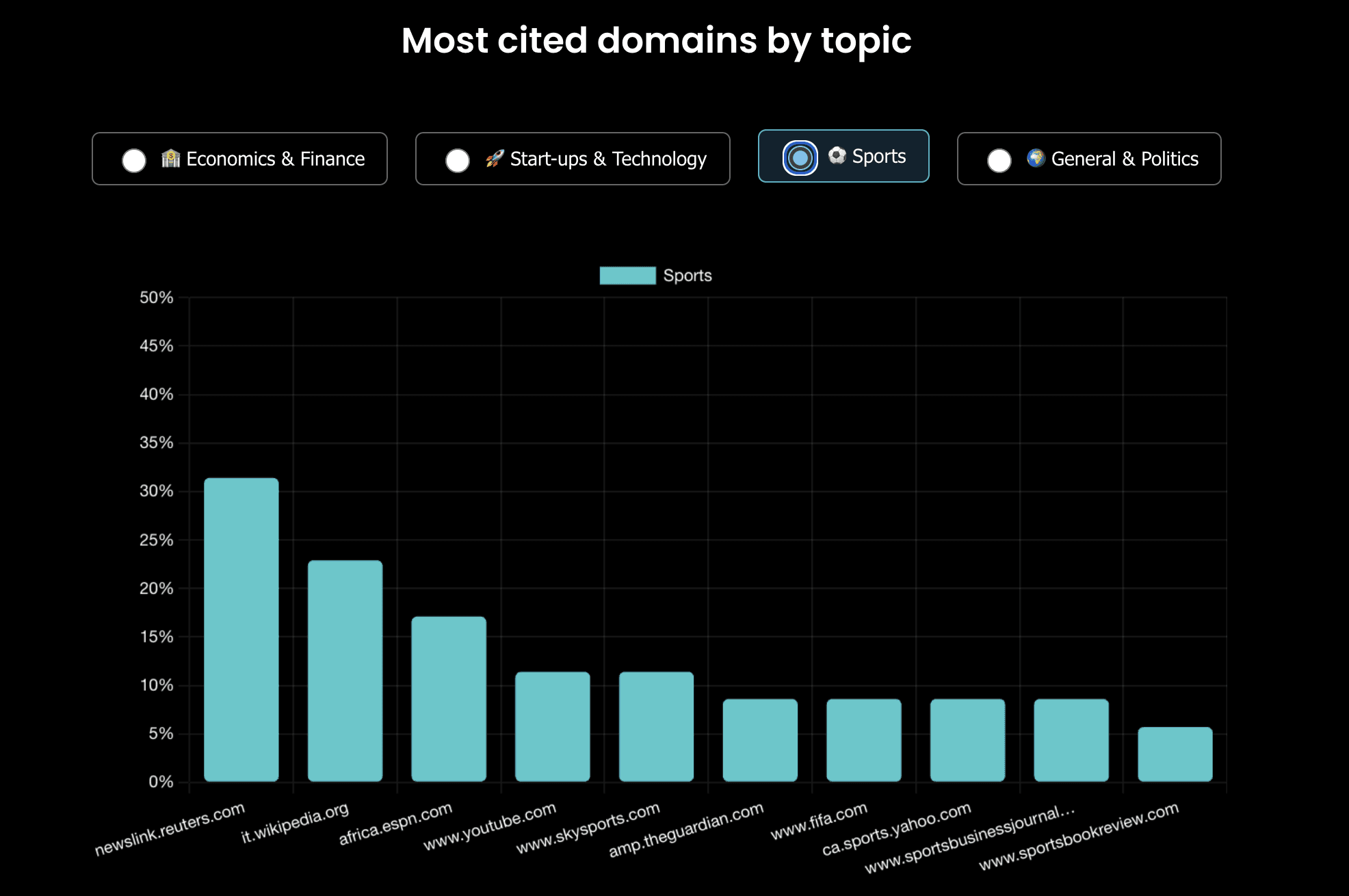

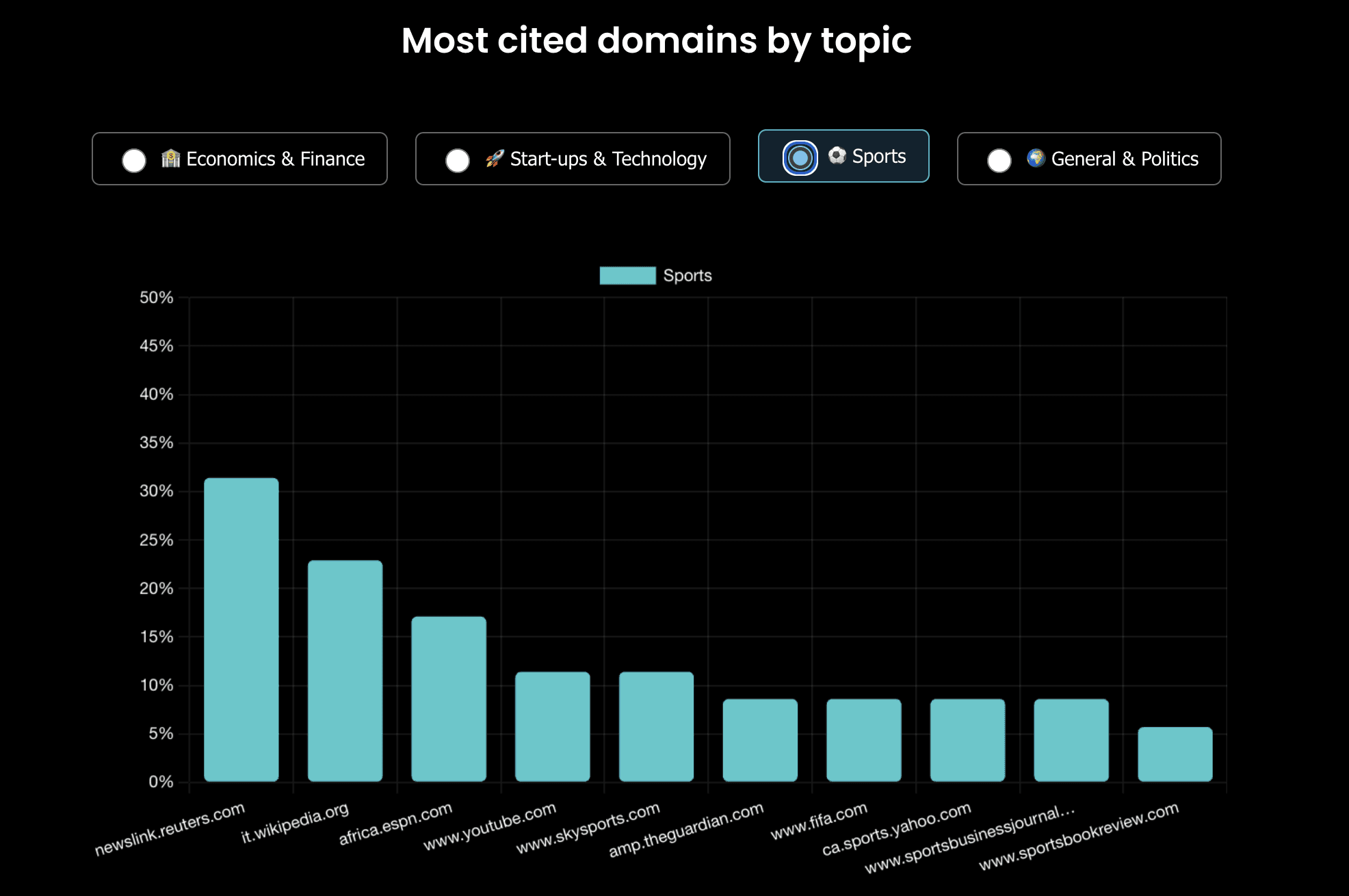

Category Analysis: Sports

Sports coverage shows distinct patterns favoring ESPN's edition, official sports organizations, and British sports media, with notable presence from video platforms and betting-related content sources.

Reuters maintains 31.4% citation rate (up from 30.8%), showing relatively stable performance and less dominance than in other categories.

Wikipedia captures 22.9% (up from 17.9%), indicating frequent reference to sports statistics, player biographies, and competition histories.

ESPN leads specialist sports coverage at 17.1% (down from 28.2%), experiencing significant decline but remaining the top dedicated sports publisher.

YouTube shows 11.4% (down from 12.8%), reflecting consistent presence of video content for sports highlights and analysis.

Sky Sports maintains 11.4% (up from 10.3%), demonstrating that British sports broadcasters achieve strong visibility alongside international wire services.

Multiple sports business and betting-related sources appear in top performers: FIFA (8.6%), Yahoo Sports (8.6%), Sports Business Journal (8.6%), and Sportsbookreview (5.7%), indicating diverse query types from game results to business coverage to betting information.

Guardian captures 8.6% in Sports (down from 10.3%), showing British general news publishers maintain competitive sports coverage visibility.

Key Takeaway: Sports demonstrates the most diverse source mix of any category, with official organizations, international broadcasters, business publishers, and betting information sources all achieving meaningful visibility. The category appears less concentrated around wire services than Economics or General News, suggesting that specialized sports knowledge, video content, and real-time statistical information may carry comparable weight to traditional news authority. The presence of betting-related sources indicates AI models may interpret some sports queries as seeking wagering information rather than pure editorial coverage, a factor sports publishers should consider in their content strategy.

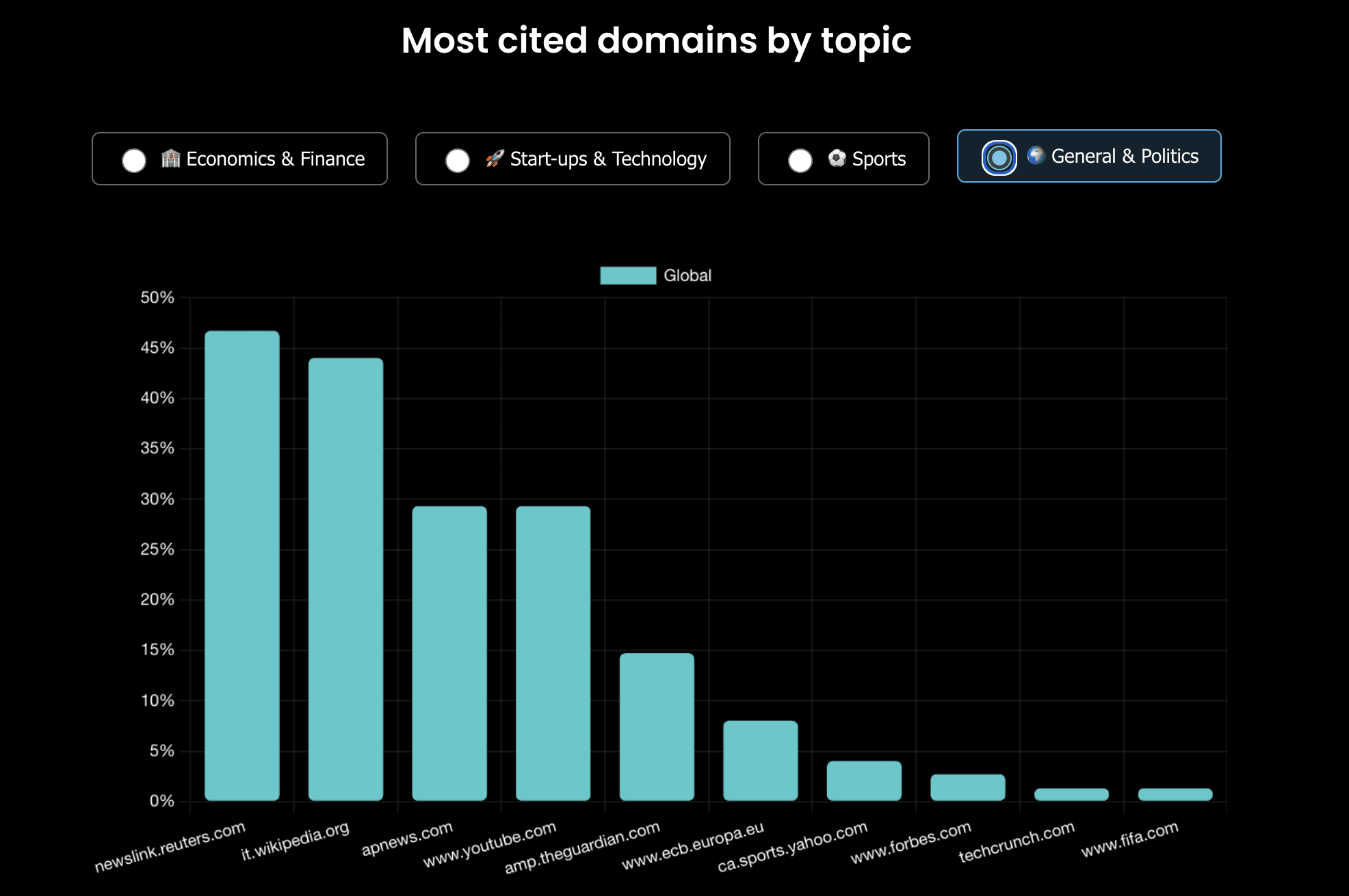

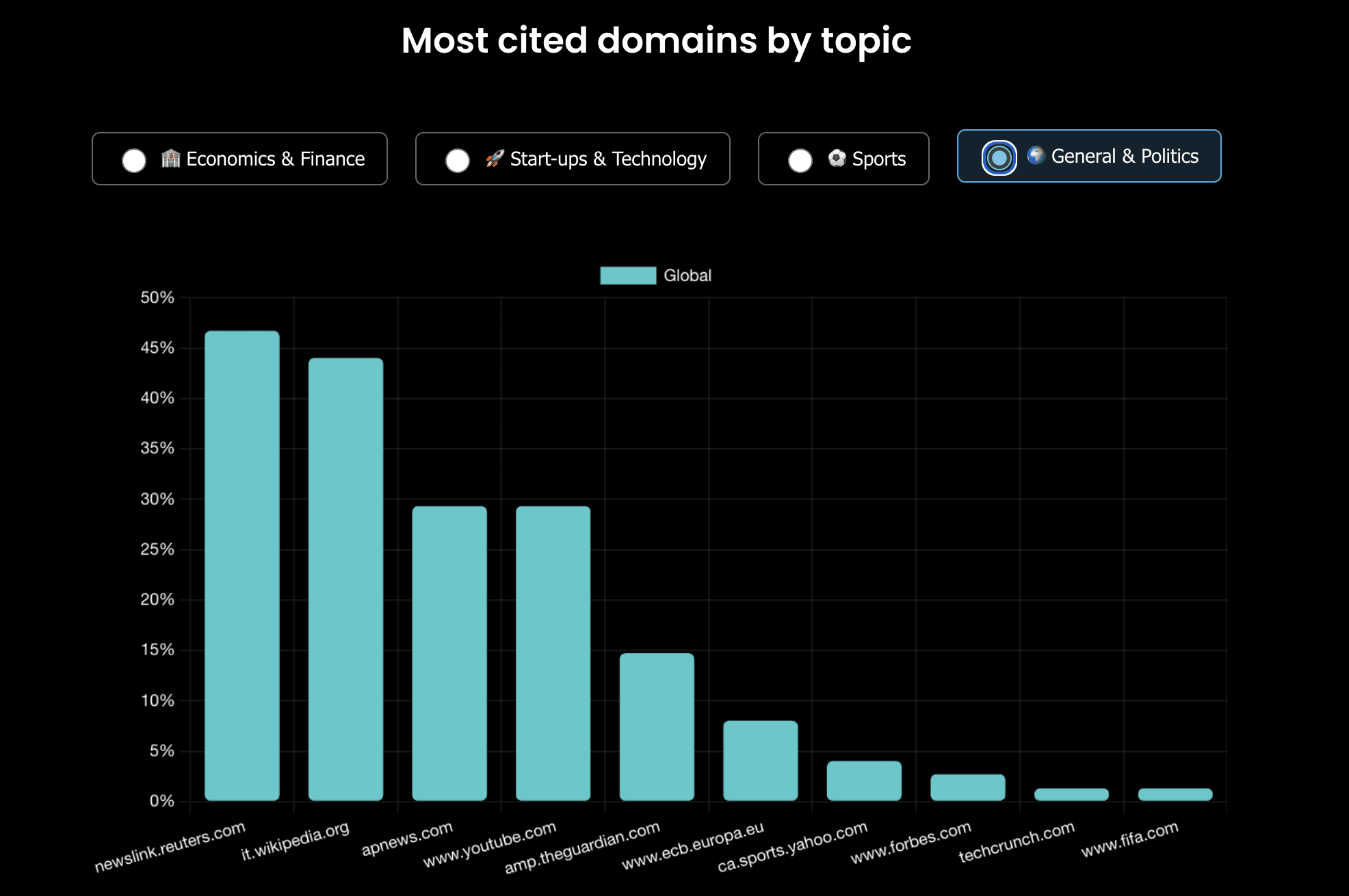

Category Analysis: General News & Politics

General News & Politics shows balanced competition between wire services, Wikipedia, and video platforms, with less concentration than Economics but more than Technology or Sports.

Reuters leads at 46.7% (up from 41.7%), capturing nearly half of citations and demonstrating stronger wire service dominance than in Sports or Technology but less than Economics & Finance.

Wikipedia maintains substantial presence at 44.0% (up from 38.1%), approaching parity with Reuters and indicating heavy reliance on reference material for political background, historical context, and biographical information.

AP News captures 29.3% (up from 22.6%), showing increased visibility for the second major wire service and suggesting many political queries receive citations from multiple wire sources.

YouTube appears at 29.3% (up from 21.4%), matching AP News and indicating significant preference for video content in general news contexts, possibly for press conferences, speeches, and visual reporting.

Guardian maintains 14.7% (up from 11.9%), demonstrating that major international newspapers achieve meaningful visibility in general news categories.

European Central Bank appears at 8.0% even in General News (down from 7.1%), indicating economic institutions receive citations beyond purely financial queries when economic policy intersects with political coverage.

Forbes (2.7%) and TechCrunch (1.3%) show minimal presence, indicating category specialization matters for visibility—business and technology publishers struggle to compete in general political coverage.

Key Takeaway: General News & Politics demonstrates a two-tier structure with Reuters and Wikipedia capturing roughly 45% each at the top, followed by wire services, video platforms, and major international newspapers at lower but meaningful levels. The substantial increase in YouTube citations (up 7.9 percentage points) may reflect news cycles favoring visual content this week or broader AI model preferences for video sources in breaking news contexts. The near-parity between Reuters and Wikipedia suggests AI models frequently consult both news and reference sources for political queries, indicating publishers compete not just with other news organizations but with reference content for visibility.

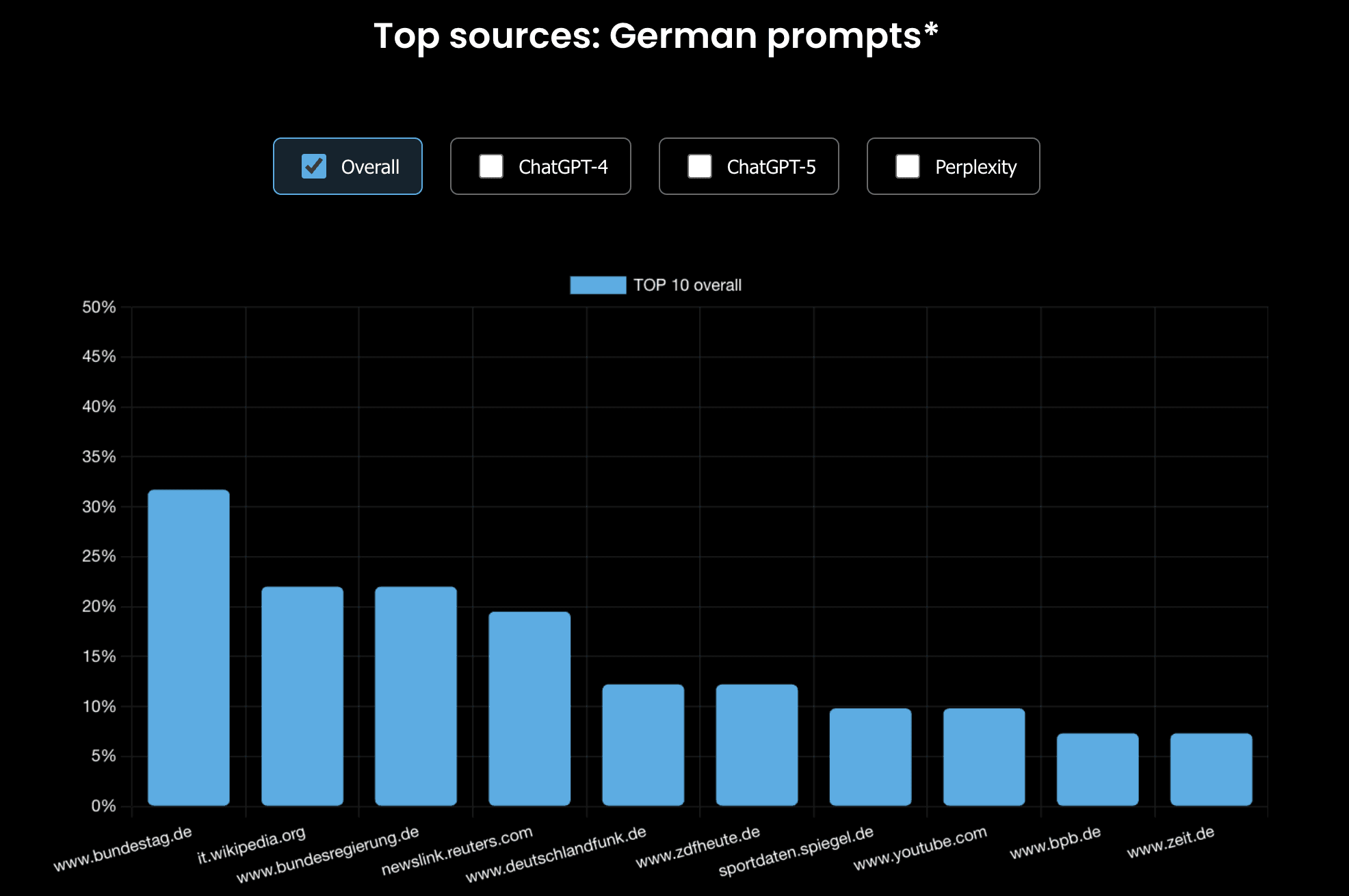

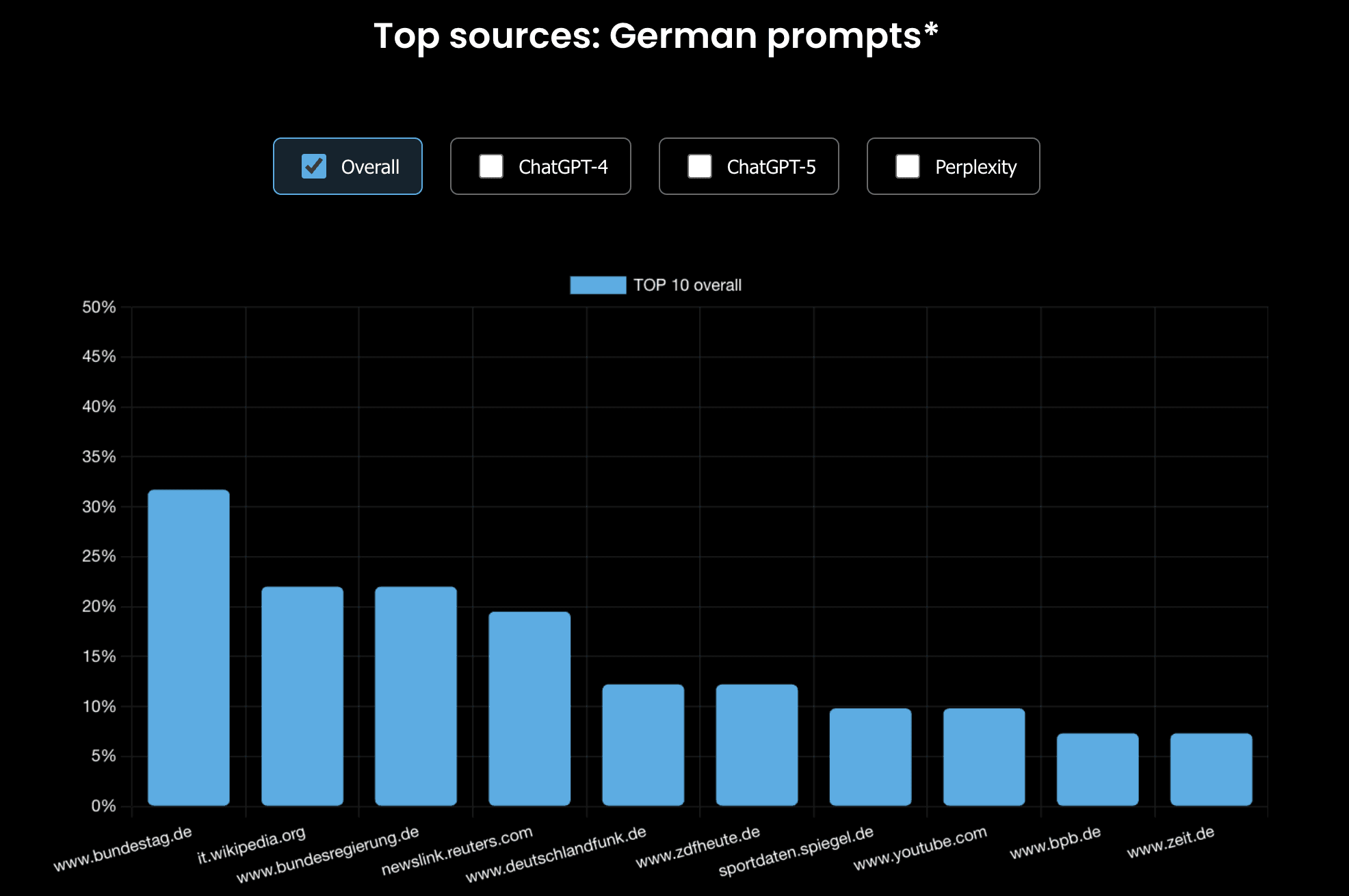

Regional Analysis: German-Language Market

German-language queries demonstrate distinctly different citation patterns from English-language searches, with government and public broadcasting sources achieving prominence unmatched by commercial media outlets.

Institutional Dominance

Bundestag (German parliament) leads at 31.7% overall (up from 26.9%), capturing the highest citation rate of any source across all German queries and showing particularly strong performance on ChatGPT-5 (35.7%, up from 25.0%) and Perplexity (50.0%, up from 27.8%).

Bundesregierung (Federal Government) maintains 22.0% overall (up from 11.5%), with particularly strong Perplexity visibility at 42.9% (up from 16.7%), indicating German government sources receive preferential treatment on certain platforms.

Public broadcasters show mixed performance: ZDF maintains 12.2% (down from 19.2%) and Deutschlandfunk holds 12.2% (unchanged from 13.5%), demonstrating that public media competes with but doesn't displace government sources.

Commercial Media Performance

Reuters maintains 19.5% overall (up from 19.2%), showing consistent presence across German queries despite language difference from primary English content.

Zeit and Welt each appear at 7.3%, indicating major German commercial newspapers achieve modest but limited visibility compared to institutional sources.

Focus.de, which appeared at 11.5% previous week, falls outside the top 10 this week, demonstrating volatility in commercial media citations.

Spiegel (via sportdaten.spiegel.de) maintains 9.8% (down from 11.5%), with presence concentrated in sports-related queries via its data subdomain.

Key Takeaway: German-language queries reveal a fundamentally different citation hierarchy than English-language searches, with government institutions and public broadcasters capturing the majority of visibility while commercial media achieves limited presence. The dramatic platform differences, ChatGPT-4's Wikipedia preference versus ChatGPT-5's Reuters/government focus versus Perplexity's institutional concentration, indicate that German-language AI visibility strategies must account for platform-specific behaviors more than English-language strategies. Commercial German publishers face the dual challenge of competing with both government sources and international wire services, suggesting that breaking into German-language AI citations requires either institutional authority or integration with international newswire distribution.

Strategic Implications

Citation Volatility and Content Planning

The substantial week-over-week changes observed across multiple sources and categories indicate publishers should approach AI visibility as a dynamic rather than static challenge.

TechCrunch experienced a 12+ percentage point decline in technology coverage (from 26.9% to 14.6%), demonstrating that even established category leaders face significant volatility.

European Central Bank nearly doubled its citation rate (from 16.1% to 25.0%) in Economics & Finance, likely reflecting news cycles focused on monetary policy rather than permanent algorithmic changes.

YouTube showed increases across multiple categories (up 7.9 points in General News, down slightly in Sports), suggesting video platform presence fluctuates with content type and news cycle rather than maintaining stable patterns.

Multiple sources that appeared in previous week's top 10 fell outside current rankings entirely, including Democracy Now, Axios in some categories, and several regional publishers, indicating the threshold for top-10 visibility shifts week to week.

Key Takeaway: Publishers should interpret single-week citation data as indicative of current patterns rather than predictive of future performance. The week-over-week volatility observed across wire services, specialists, and platforms suggests that content strategies optimized for AI visibility require continuous adjustment rather than one-time optimization. Sustained visibility likely demands consistent publishing across multiple topic areas and formats rather than concentration in single categories where algorithmic or news-cycle shifts can substantially impact citation rates.

Specialization Versus Breadth Trade-offs

Different categories show markedly different concentration patterns, suggesting specialization strategies carry both opportunities and risks depending on subject area.

Economics & Finance shows the highest concentration, with Reuters and institutional sources capturing dominant share, making competitive entry challenging but potentially rewarding for financial specialists who achieve recognition.

Start-ups & Technology demonstrates more distributed patterns, with multiple specialist publishers (TechStartups, EU-Startups, Tech.eu, Sifted) achieving double-digit citation rates alongside Reuters, indicating specialization provides differentiation.

Sports shows the most balanced distribution, with official organizations, broadcasters, and news publishers all maintaining meaningful presence, suggesting diverse entry points for specialized coverage.

General News & Politics reveals two-tier structure dominated by Reuters and Wikipedia, with secondary tier requiring either wire service distribution, major brand recognition, or video format to achieve visibility.

Key Takeaway: Specialization appears most viable in Technology and Sports categories where multiple focused publishers achieve competitive citation rates, while Economics & Finance and General News show concentration that favors wire services and institutional sources. Publishers should assess category concentration patterns when deciding between specialist depth and general breadth strategies, recognizing that highly concentrated categories may require institutional authority or wire service relationships to achieve meaningful AI visibility.

Conclusion

This week's AI search citation patterns demonstrate continued volatility across platforms and categories, with Reuters and Wikipedia maintaining leadership positions while institutional sources, specialists, and video platforms capture varying share depending on query type. The substantial week-over-week changes—from TechCrunch's decline to ECB's increase to shifting YouTube presence—underscore that single-week patterns reflect current news cycles and content availability as much as stable algorithmic preferences. For publishers navigating AI visibility, these patterns suggest that sustained, multi-platform presence across diverse content types may prove more valuable than optimization for specific categories or platforms. Tools like ALLMO.ai provide essential ongoing monitoring to distinguish temporary fluctuations from emerging trends in this rapidly evolving landscape.

AI Search Weekly: Publisher Visibility Report

As AI-powered search platforms reshape how audiences discover content, understanding citation patterns across different models becomes essential for publishers. This week's analysis of ChatGPT-4, ChatGPT-5, and Perplexity reveals continued volatility in citation rates, with notable shifts across categories and platforms. The data, drawn from ALLMO.ai's ongoing research using diverse prompts spanning news topics, economics, technology, and sports, captures a moment in the rapidly evolving AI search landscape. See the full data at allmo.ai/trends.

The patterns observed this week show substantial movement in several key metrics, particularly in how different content categories perform and which institutional versus commercial sources gain prominence. For publishers navigating AI visibility strategies, these weekly fluctuations underscore the importance of continuous monitoring rather than assuming stable citation patterns. The data reveals distinct platform preferences and category-specific dynamics that suggest different optimization approaches may be necessary for different types of content.

While single-week observations naturally reflect current news cycles and content availability rather than permanent algorithmic shifts, tracking these patterns over time helps identify which changes represent temporary fluctuations versus emerging trends in how AI systems select and cite sources.

Top 3 Highlights

1. Reuters Maintains Strong Overall Presence Despite Week-Over-Week Decline

Reuters leads in Economics & Finance with 65.0% citation rate (up from 51.6%), but shows an overall decrease from 36.3% to approximately 42% across all categories when weighted by the data. This indicates category-specific strength in financial topics while experiencing softer performance in other areas. The wire service's volatility across categories reflects how AI citation patterns can shift substantially based on query topics and current news cycles.

2. Institutional Sources Show Concentrated Economics Performance

The European Central Bank (25.0%), Federal Reserve (15.0%), and IMF (10.0%) collectively demonstrate strong institutional authority in Economics & Finance queries. ECB's citation rate increased from 16.1% to 25.0%, suggesting heightened relevance for central bank sources. This concentration of institutional citations in financial topics contrasts with more distributed patterns in other categories, indicating that AI models may prioritize official economic sources more heavily than in other subject areas.

3. Technology Category Shows Balanced Citation Distribution

In Start-ups & Technology, the top source (Reuters at 26.8%) shows less dominance than in Economics & Finance, with specialist publishers TechStartups (17.1%), TechCrunch (14.6%, down from 26.9%), and multiple niche European startup outlets capturing meaningful share. This more distributed pattern suggests that AI models may recognize category expertise differently across subject areas, potentially offering opportunities for specialized publishers in technology coverage.

Overall Platform Leaders

This week's data reveals substantial variation in citation patterns across all platforms, with Reuters and Wikipedia maintaining top positions but showing notable fluctuations. The presence of institutional sources and category specialists varies considerably, reflecting different content needs across query types.

Platform-Specific Patterns

Reuters leads with approximately 42% overall citation rate when averaged across categories (down from 36.3% previous week), maintaining strongest performance in Economics & Finance (65.0%) and General & Politics (46.7%).

Wikipedia shows 22-44% citation rates depending on category, with highest visibility in General & Politics (44.0%) and lowest in Economics & Finance (15.0%, down slightly from 16.1%).

AP News captures 15-29% across categories, demonstrating consistent wire service presence with particular strength in General & Politics (29.3%, up from 22.6%).

YouTube maintains significant presence at 9.8-29.3% depending on category, showing strongest performance in General & Politics (29.3%, up from 21.4%) and Sports (11.4%), likely reflecting video content preferences for these topics.

The Guardian appears at 8.6-14.7% across Sports and General & Politics categories, though its overall visibility (8.6% vs previous 8.6%) remains relatively stable week-over-week.

Key Takeaway: Platform citation patterns this week show continued volatility, with Reuters maintaining leadership despite an overall decline, while YouTube demonstrates growing presence in non-technical categories. The week-over-week fluctuations—particularly Reuters' category-specific movements and YouTube's increased visibility—likely reflect shifts in news cycles and query compositions rather than fundamental algorithmic changes. Publishers should note that consistent visibility across multiple weeks appears more challenging than capturing momentary citation peaks, suggesting the importance of sustained content strategies rather than optimizing for short-term visibility.

Category Analysis: Economics & Finance

Economics & Finance shows the highest citation concentration of any category this week, with Reuters and institutional sources capturing the majority of top citations. The category demonstrates clear hierarchy between wire services, financial data providers, and regulatory institutions.

Reuters dominates with 65.0% citation rate (up from 51.6%), capturing nearly two-thirds of Economics & Finance citations and showing the strongest category-specific performance of any source in any category.

European Central Bank maintains substantial institutional presence at 25.0% (up from 16.1%), nearly doubling its week-over-week citation rate and indicating heightened relevance for central bank sources.

Investing.com appears at 20.0% (up from 12.9%), demonstrating that specialized financial data platforms can achieve meaningful visibility alongside traditional news sources.

AP News (15.0%, down from 22.6%) and Federal Reserve (15.0%, unchanged) share equal citation rates, showing how wire services and primary institutional sources compete for visibility.

Multiple international financial institutions (IMF at 10.0%, S&P Global at 10.0%, UNCTAD at 10.0%) each capture double-digit percentages, suggesting AI models frequently consult multiple authoritative sources for economic queries.

CNBC appears at 10.0% (down from 12.9%), indicating financial news broadcasters maintain but do not dominate citation patterns in this category.

Key Takeaway: Economics & Finance shows the most concentrated citation pattern of any category, with Reuters and institutional sources capturing the vast majority of visibility. The increased presence of central banks and international financial organizations (ECB up 8.9 percentage points, for example) may reflect current economic news cycles focusing on monetary policy and institutional analysis. This concentration presents significant challenges for general news publishers seeking economics visibility, while suggesting that specialized financial publishers must compete directly with both wire services and primary institutional sources.

Category Analysis: Start-ups & Technology

Start-ups & Technology demonstrates notably more distributed citations compared to Economics & Finance, with specialist publishers capturing significant share alongside Reuters. The category shows stronger performance from niche European technology outlets than mainstream U.S. tech publishers.

Reuters leads at 26.8% (up from 23.1%), maintaining first position but with substantially less dominance than in Economics & Finance, allowing more room for specialist competitors.

Wikipedia captures 17.1% (up from 9.6%), showing increased reliance on reference material for technology topics, possibly for company background and technical definitions.

TechStartups appears at 17.1% (up from 15.4%), matching Wikipedia and demonstrating that dedicated startup-focused publishers can achieve parity with general reference sources.

TechCrunch shows 14.6% (down substantially from 26.9%), experiencing the largest week-over-week decline among top technology sources and falling from clear second position.

European specialist outlets show notable presence: EU-Startups (12.2%), Tech.eu (9.8%), and Sifted (9.8%) collectively capture approximately 30% of citations, indicating AI models may value regional specialization for European startup coverage.

Crunchbase News maintains 12.2% (down from 13.5%), demonstrating that database-affiliated editorial content achieves competitive visibility.

Forbes appears at 12.2% (up from 9.6%), showing business publications can compete effectively in technology categories despite not being technology-specialist outlets.

Key Takeaway: The technology category's more distributed citation pattern indicates that specialist expertise may carry more weight than in economics coverage, where institutional and wire service authority dominates. TechCrunch's 12+ percentage point decline, however, demonstrates that even established technology publishers face significant week-to-week volatility, likely reflecting shifts in query focus between consumer technology, enterprise coverage, and startup funding news. The strong collective performance of European specialist outlets suggests geographic and topical specialization provides differentiation that AI models recognize, potentially offering a strategic pathway for niche technology publishers.

Category Analysis: Sports

Sports coverage shows distinct patterns favoring ESPN's edition, official sports organizations, and British sports media, with notable presence from video platforms and betting-related content sources.

Reuters maintains 31.4% citation rate (up from 30.8%), showing relatively stable performance and less dominance than in other categories.

Wikipedia captures 22.9% (up from 17.9%), indicating frequent reference to sports statistics, player biographies, and competition histories.

ESPN leads specialist sports coverage at 17.1% (down from 28.2%), experiencing significant decline but remaining the top dedicated sports publisher.

YouTube shows 11.4% (down from 12.8%), reflecting consistent presence of video content for sports highlights and analysis.

Sky Sports maintains 11.4% (up from 10.3%), demonstrating that British sports broadcasters achieve strong visibility alongside international wire services.

Multiple sports business and betting-related sources appear in top performers: FIFA (8.6%), Yahoo Sports (8.6%), Sports Business Journal (8.6%), and Sportsbookreview (5.7%), indicating diverse query types from game results to business coverage to betting information.

Guardian captures 8.6% in Sports (down from 10.3%), showing British general news publishers maintain competitive sports coverage visibility.

Key Takeaway: Sports demonstrates the most diverse source mix of any category, with official organizations, international broadcasters, business publishers, and betting information sources all achieving meaningful visibility. The category appears less concentrated around wire services than Economics or General News, suggesting that specialized sports knowledge, video content, and real-time statistical information may carry comparable weight to traditional news authority. The presence of betting-related sources indicates AI models may interpret some sports queries as seeking wagering information rather than pure editorial coverage, a factor sports publishers should consider in their content strategy.

Category Analysis: General News & Politics

General News & Politics shows balanced competition between wire services, Wikipedia, and video platforms, with less concentration than Economics but more than Technology or Sports.

Reuters leads at 46.7% (up from 41.7%), capturing nearly half of citations and demonstrating stronger wire service dominance than in Sports or Technology but less than Economics & Finance.

Wikipedia maintains substantial presence at 44.0% (up from 38.1%), approaching parity with Reuters and indicating heavy reliance on reference material for political background, historical context, and biographical information.

AP News captures 29.3% (up from 22.6%), showing increased visibility for the second major wire service and suggesting many political queries receive citations from multiple wire sources.

YouTube appears at 29.3% (up from 21.4%), matching AP News and indicating significant preference for video content in general news contexts, possibly for press conferences, speeches, and visual reporting.

Guardian maintains 14.7% (up from 11.9%), demonstrating that major international newspapers achieve meaningful visibility in general news categories.

European Central Bank appears at 8.0% even in General News (down from 7.1%), indicating economic institutions receive citations beyond purely financial queries when economic policy intersects with political coverage.

Forbes (2.7%) and TechCrunch (1.3%) show minimal presence, indicating category specialization matters for visibility—business and technology publishers struggle to compete in general political coverage.

Key Takeaway: General News & Politics demonstrates a two-tier structure with Reuters and Wikipedia capturing roughly 45% each at the top, followed by wire services, video platforms, and major international newspapers at lower but meaningful levels. The substantial increase in YouTube citations (up 7.9 percentage points) may reflect news cycles favoring visual content this week or broader AI model preferences for video sources in breaking news contexts. The near-parity between Reuters and Wikipedia suggests AI models frequently consult both news and reference sources for political queries, indicating publishers compete not just with other news organizations but with reference content for visibility.

Regional Analysis: German-Language Market

German-language queries demonstrate distinctly different citation patterns from English-language searches, with government and public broadcasting sources achieving prominence unmatched by commercial media outlets.

Institutional Dominance

Bundestag (German parliament) leads at 31.7% overall (up from 26.9%), capturing the highest citation rate of any source across all German queries and showing particularly strong performance on ChatGPT-5 (35.7%, up from 25.0%) and Perplexity (50.0%, up from 27.8%).

Bundesregierung (Federal Government) maintains 22.0% overall (up from 11.5%), with particularly strong Perplexity visibility at 42.9% (up from 16.7%), indicating German government sources receive preferential treatment on certain platforms.

Public broadcasters show mixed performance: ZDF maintains 12.2% (down from 19.2%) and Deutschlandfunk holds 12.2% (unchanged from 13.5%), demonstrating that public media competes with but doesn't displace government sources.

Commercial Media Performance

Reuters maintains 19.5% overall (up from 19.2%), showing consistent presence across German queries despite language difference from primary English content.

Zeit and Welt each appear at 7.3%, indicating major German commercial newspapers achieve modest but limited visibility compared to institutional sources.

Focus.de, which appeared at 11.5% previous week, falls outside the top 10 this week, demonstrating volatility in commercial media citations.

Spiegel (via sportdaten.spiegel.de) maintains 9.8% (down from 11.5%), with presence concentrated in sports-related queries via its data subdomain.

Key Takeaway: German-language queries reveal a fundamentally different citation hierarchy than English-language searches, with government institutions and public broadcasters capturing the majority of visibility while commercial media achieves limited presence. The dramatic platform differences, ChatGPT-4's Wikipedia preference versus ChatGPT-5's Reuters/government focus versus Perplexity's institutional concentration, indicate that German-language AI visibility strategies must account for platform-specific behaviors more than English-language strategies. Commercial German publishers face the dual challenge of competing with both government sources and international wire services, suggesting that breaking into German-language AI citations requires either institutional authority or integration with international newswire distribution.

Strategic Implications

Citation Volatility and Content Planning

The substantial week-over-week changes observed across multiple sources and categories indicate publishers should approach AI visibility as a dynamic rather than static challenge.

TechCrunch experienced a 12+ percentage point decline in technology coverage (from 26.9% to 14.6%), demonstrating that even established category leaders face significant volatility.

European Central Bank nearly doubled its citation rate (from 16.1% to 25.0%) in Economics & Finance, likely reflecting news cycles focused on monetary policy rather than permanent algorithmic changes.

YouTube showed increases across multiple categories (up 7.9 points in General News, down slightly in Sports), suggesting video platform presence fluctuates with content type and news cycle rather than maintaining stable patterns.

Multiple sources that appeared in previous week's top 10 fell outside current rankings entirely, including Democracy Now, Axios in some categories, and several regional publishers, indicating the threshold for top-10 visibility shifts week to week.

Key Takeaway: Publishers should interpret single-week citation data as indicative of current patterns rather than predictive of future performance. The week-over-week volatility observed across wire services, specialists, and platforms suggests that content strategies optimized for AI visibility require continuous adjustment rather than one-time optimization. Sustained visibility likely demands consistent publishing across multiple topic areas and formats rather than concentration in single categories where algorithmic or news-cycle shifts can substantially impact citation rates.

Specialization Versus Breadth Trade-offs

Different categories show markedly different concentration patterns, suggesting specialization strategies carry both opportunities and risks depending on subject area.

Economics & Finance shows the highest concentration, with Reuters and institutional sources capturing dominant share, making competitive entry challenging but potentially rewarding for financial specialists who achieve recognition.

Start-ups & Technology demonstrates more distributed patterns, with multiple specialist publishers (TechStartups, EU-Startups, Tech.eu, Sifted) achieving double-digit citation rates alongside Reuters, indicating specialization provides differentiation.

Sports shows the most balanced distribution, with official organizations, broadcasters, and news publishers all maintaining meaningful presence, suggesting diverse entry points for specialized coverage.

General News & Politics reveals two-tier structure dominated by Reuters and Wikipedia, with secondary tier requiring either wire service distribution, major brand recognition, or video format to achieve visibility.

Key Takeaway: Specialization appears most viable in Technology and Sports categories where multiple focused publishers achieve competitive citation rates, while Economics & Finance and General News show concentration that favors wire services and institutional sources. Publishers should assess category concentration patterns when deciding between specialist depth and general breadth strategies, recognizing that highly concentrated categories may require institutional authority or wire service relationships to achieve meaningful AI visibility.

Conclusion

This week's AI search citation patterns demonstrate continued volatility across platforms and categories, with Reuters and Wikipedia maintaining leadership positions while institutional sources, specialists, and video platforms capture varying share depending on query type. The substantial week-over-week changes—from TechCrunch's decline to ECB's increase to shifting YouTube presence—underscore that single-week patterns reflect current news cycles and content availability as much as stable algorithmic preferences. For publishers navigating AI visibility, these patterns suggest that sustained, multi-platform presence across diverse content types may prove more valuable than optimization for specific categories or platforms. Tools like ALLMO.ai provide essential ongoing monitoring to distinguish temporary fluctuations from emerging trends in this rapidly evolving landscape.

About the author

ALLMO.ai Team

ALLMO.ai helps brands measure and improve their visibility in AI-generated search results like ChatGPT and Perplexity. It provides optimization insights, recommendations to increase your brands visibility, and URL warm-up to get new content crawled and discovered faster.

Check out more articles

Start your AI Search Optimization journey today!

Applied Large Language Model Optimization (ALLMO), also known as GEO/AEO is gaining strong momentum.